Ingénierie des réservoirs

Probable Reserves (2P)

Débloquer le Potentiel : Les Réserves 2P dans le Pétrole et le Gaz

Dans le monde de l'exploration et de la production pétrolières et gazières, la compréhension des estimations des ressources est cruciale. Un terme clé utilisé dans cette industrie est les "réserves 2P", un terme souvent rencontré dans les rapports et les présentations. Cet article vise à démystifier le concept des réserves 2P, en soulignant son importance et ses différences avec les autres catégories de ressources.

Que sont les réserves 2P ?

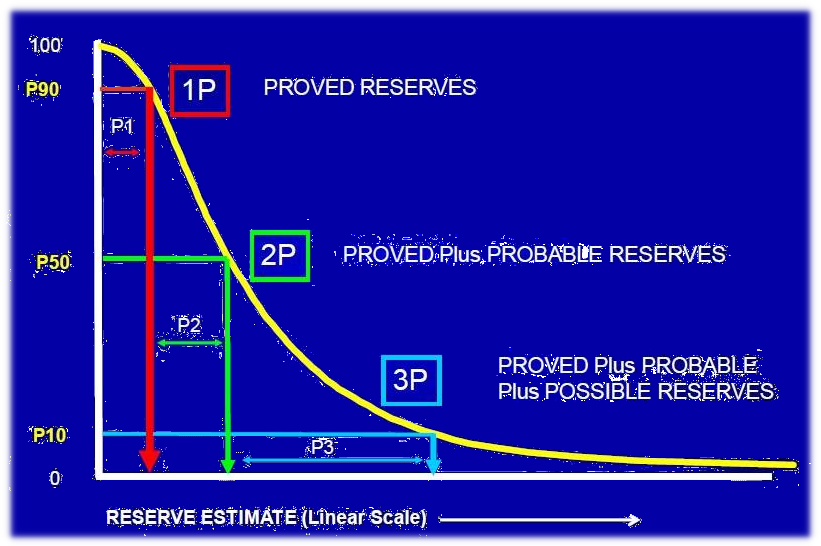

Les réserves 2P, également connues sous le nom de "réserves prouvées plus probables", représentent la quantité estimée de pétrole ou de gaz qui est considérée comme **hautement probable** d'être récupérable dans les conditions économiques et opérationnelles actuelles. Cette catégorie englobe deux éléments clés:

- Réserves prouvées (1P) : Ces réserves ont un degré de certitude élevé. Elles sont basées sur des données de forage et de test exhaustives, indiquant que l'extraction est à la fois techniquement réalisable et commercialement viable.

- Réserves probables (2P) : Ces réserves ont un niveau de certitude légèrement inférieur à celui des réserves prouvées. Bien qu'il existe de solides preuves géologiques et d'ingénierie à l'appui de leur existence, il peut y avoir une certaine incertitude quant à leur taille exacte ou à leur récupérabilité.

Comprendre la Différence :

Il est essentiel de différencier les réserves 2P des autres catégories de ressources telles que :

- Réserves possibles (3P) : Ces réserves ont un degré de certitude inférieur à celui des réserves probables. Elles reposent sur des données moins concluantes et peuvent être conditionnelles à des avancées techniques spécifiques ou à des conditions du marché futures.

- Ressources contingentes : Ce sont des ressources qui pourraient être récupérables, mais qui nécessitent des actions spécifiques, telles que des approbations réglementaires ou des augmentations de prix, pour devenir économiquement viables.

Importance des Réserves 2P :

Les réserves 2P sont très importantes pour les différentes parties prenantes de l'industrie pétrolière et gazière :

- Investisseurs : Les réserves 2P constituent un indicateur solide de la rentabilité potentielle et des bénéfices futurs d'une entreprise. Elles sont souvent utilisées pour évaluer la valeur d'une société pétrolière et gazière.

- Prêteurs : Les banques et autres prêteurs utilisent les réserves 2P pour évaluer la solvabilité des sociétés pétrolières et gazières qui cherchent à obtenir un financement.

- Gouvernements : Les gouvernements s'appuient sur les réserves 2P pour surveiller la disponibilité des ressources, planifier la production énergétique future et gérer les redevances.

Limitations des Réserves 2P :

Bien que les réserves 2P offrent des informations précieuses, il est important d'être conscient de leurs limites:

- Les estimations sont basées sur les conditions actuelles : Les réserves 2P sont estimées en fonction des conditions économiques et technologiques prévalant. Des changements dans ces facteurs pourraient avoir une incidence sur la quantité réelle de ressources récupérables.

- L'incertitude est inhérente : Même avec de solides preuves, il subsiste un certain degré d'incertitude associé aux réserves 2P. De nouvelles découvertes géologiques ou des avancées technologiques pourraient modifier la quantité estimée.

Conclusion :

Les réserves 2P jouent un rôle crucial dans l'industrie pétrolière et gazière. Comprendre ce concept aide les investisseurs, les prêteurs et les gouvernements à prendre des décisions éclairées. Bien que ces estimations fournissent un instantané précieux du potentiel de ressources d'une entreprise, il est essentiel de reconnaître qu'elles sont sujettes à changement en fonction de l'évolution de la dynamique du marché et des progrès technologiques.

Test Your Knowledge

Quiz: Unlocking the Potential: 2P Reserves in Oil & Gas

Instructions: Choose the best answer for each question.

1. What does "2P reserves" stand for? a) Proved plus probable reserves b) Potential plus probable reserves c) Possible plus probable reserves d) Proved plus possible reserves

Answer

a) Proved plus probable reserves

2. Which of the following is NOT included in 2P reserves? a) Proved reserves b) Probable reserves c) Possible reserves d) Contingent resources

Answer

c) Possible reserves

3. What is the main difference between proved and probable reserves? a) Proved reserves are based on less conclusive data than probable reserves. b) Probable reserves have a higher degree of certainty than proved reserves. c) Proved reserves have a higher degree of certainty than probable reserves. d) There is no difference between proved and probable reserves.

Answer

c) Proved reserves have a higher degree of certainty than probable reserves.

4. Which stakeholder group uses 2P reserves to assess a company's creditworthiness? a) Investors b) Lenders c) Governments d) Consumers

Answer

b) Lenders

5. What is a major limitation of 2P reserves? a) They are always accurate and unchanging. b) They only consider technological factors, not economic ones. c) They are based on current conditions, which can change. d) They are not useful for decision-making.

Answer

c) They are based on current conditions, which can change.

Exercise: 2P Reserves Analysis

Scenario: An oil and gas company reports the following resource estimates:

- Proved Reserves: 100 million barrels

- Probable Reserves: 50 million barrels

- Possible Reserves: 20 million barrels

- Contingent Resources: 30 million barrels

Task:

- Calculate the company's total 2P reserves.

- Explain why the company's contingent resources are not included in the 2P reserve calculation.

Exercice Correction

1. **Total 2P reserves:** Proved Reserves + Probable Reserves = 100 million barrels + 50 million barrels = **150 million barrels** 2. **Contingent resources are not included in 2P reserves because they are not considered highly likely to be recoverable under current economic and operating conditions.** They require specific actions like regulatory approvals or price increases to become economically viable, making them less certain than proved or probable reserves.

Books

- Petroleum Resources Management System (PRMS): This book, published by the Society of Petroleum Engineers (SPE), provides a comprehensive overview of the PRMS, including detailed explanations of 2P reserves and other resource categories.

- Oil and Gas Economics: A Guide for the Professional: Written by James S. Lee, this book covers various aspects of oil and gas economics, including reserve estimation and valuation, which will shed light on the importance of 2P reserves.

- Petroleum Engineering Handbook: Edited by William C. Lyons, this handbook offers a detailed explanation of oil and gas production processes, including reserve estimation techniques and the concept of 2P reserves.

Articles

- "Understanding Oil and Gas Reserve Categories" by the U.S. Energy Information Administration (EIA): This article provides a clear and concise explanation of the different reserve categories, including 2P reserves, and their importance in the oil and gas industry.

- "The Difference Between Proved, Probable, and Possible Reserves" by Investopedia: This article highlights the distinctions between different reserve categories and explains how they are used in financial reporting and investment decisions.

- "Reserve Definitions & Standards" by the Society of Petroleum Engineers (SPE): This article provides a detailed overview of the SPE's reserve definitions and standards, including the criteria for classifying reserves as 2P.

Online Resources

- Society of Petroleum Engineers (SPE): The SPE website offers a vast library of resources related to oil and gas exploration and production, including articles, publications, and educational materials on reserve estimation and 2P reserves.

- U.S. Energy Information Administration (EIA): The EIA website provides extensive data and analysis on energy markets, including information on oil and gas reserves, production, and consumption.

- World Energy Council (WEC): The WEC website offers a global perspective on energy issues, including resources, technology, and policy. They have valuable resources on oil and gas reserves and their role in global energy supply.

Search Tips

- Use precise keywords like "2P reserves definition", "2P reserves vs 1P reserves", "2P reserves in oil and gas industry", "probable reserves calculation".

- Combine keywords with specific company names or regions, like "ExxonMobil 2P reserves" or "2P reserves in the North Sea".

- Use quotation marks around specific phrases to refine your search, like "proved plus probable reserves".

- Include relevant websites or organizations in your search, like "site:spe.org 2P reserves".

Techniques

Unlocking the Potential: 2P Reserves in Oil & Gas

This expanded document delves deeper into the concept of 2P (Proved Plus Probable) reserves, breaking down the topic into distinct chapters for clarity.

Chapter 1: Techniques for Estimating Probable Reserves

Estimating probable reserves (2P) relies on a combination of geological, geophysical, and engineering data. The process isn't a simple calculation but a complex evaluation incorporating uncertainty. Key techniques include:

Geological Modeling: This involves creating 3D representations of the subsurface, incorporating data from seismic surveys, well logs, core samples, and geological interpretations. The model predicts the distribution of reservoir rock, its properties (porosity, permeability), and the presence of hydrocarbons. Uncertainty is quantified through multiple realizations of the model, each representing a plausible geological scenario.

Reservoir Simulation: Once a geological model is built, reservoir simulation software is used to predict fluid flow and hydrocarbon recovery under various operating conditions. This helps determine the recoverable volume of hydrocarbons under different scenarios, incorporating uncertainties related to reservoir pressure, fluid properties, and production techniques.

Material Balance Calculations: These calculations use historical production data and reservoir pressure measurements to estimate the original hydrocarbon in place and the remaining reserves. This method is most effective in mature fields with a long history of production.

Analogue Studies: Comparing the reservoir under investigation to similar, already-produced fields can provide insights into potential recovery factors and reservoir performance. This technique is particularly useful in early exploration stages when data is limited.

Statistical Analysis: Uncertainty quantification is crucial in 2P reserve estimations. Statistical methods, such as Monte Carlo simulations, are employed to account for uncertainties in input parameters (e.g., porosity, permeability, recovery factor) and generate a probability distribution of possible reserve volumes. This allows for the assignment of probabilities to different reserve levels (e.g., P10, P50, P90).

Chapter 2: Models Used in 2P Reserve Estimation

Various models are used to estimate 2P reserves, each with its strengths and limitations. The choice of model depends on the available data, the reservoir characteristics, and the level of uncertainty.

Deterministic Models: These models use single best-estimate values for input parameters. While simpler to use, they fail to capture the inherent uncertainties associated with reservoir characterization.

Probabilistic Models: These models account for uncertainty by using probability distributions for input parameters. Monte Carlo simulations are frequently used to generate a range of possible reserve estimates, providing a more realistic representation of the uncertainty.

Geostatistical Models: These models use spatial statistics to interpolate data from well locations to create continuous reservoir property maps. Kriging and sequential Gaussian simulation are common geostatistical techniques used in reservoir modeling.

Dynamic Models: Reservoir simulation models are dynamic models that predict fluid flow and pressure changes over time. These models are crucial for assessing the impact of different production strategies on recoverable reserves.

Chapter 3: Software for 2P Reserve Estimation

Specialized software packages are used to perform the complex calculations and simulations involved in 2P reserve estimation. These packages integrate various functionalities required for geological modeling, reservoir simulation, and uncertainty analysis. Examples include:

Petrel (Schlumberger): A widely used integrated reservoir modeling and simulation platform.

Eclipse (Schlumberger): A powerful reservoir simulator used for predicting hydrocarbon production and recovery.

CMG (Computer Modelling Group): Another popular reservoir simulation suite offering various functionalities.

RMS (Roxar): Provides tools for reservoir characterization, simulation, and production forecasting.

These software packages often incorporate functionalities for data management, visualization, and reporting, aiding in the efficient and accurate estimation of 2P reserves.

Chapter 4: Best Practices in 2P Reserve Estimation

Adhering to best practices ensures the reliability and credibility of 2P reserve estimates. Key best practices include:

Data Quality Control: Accurate and reliable data is crucial. Rigorous data validation and quality control are essential before any modeling or simulation is undertaken.

Independent Audits: Independent audits of reserve estimates are often required by regulatory bodies and investors to ensure transparency and objectivity.

Transparency and Documentation: The entire reserve estimation process should be well-documented, including data sources, assumptions made, and methodologies used.

Use of Qualified Professionals: Reserve estimation should be conducted by qualified petroleum engineers and geologists with extensive experience in the field.

Compliance with Industry Standards: Following industry standards like those published by the Society of Petroleum Engineers (SPE) ensures consistency and comparability of reserve estimates.

Chapter 5: Case Studies of 2P Reserve Estimation

Case studies illustrate how 2P reserves are estimated in real-world scenarios. These studies demonstrate the application of the techniques and models discussed above, highlighting the challenges and uncertainties encountered. Specific case studies would focus on diverse reservoir types (e.g., conventional, unconventional) and demonstrate how the methodologies were adapted to the specific challenges posed by each case. Examples could include:

- A case study detailing the 2P reserve estimation of a mature oil field using material balance calculations and reservoir simulation.

- A case study showing the use of probabilistic methods to assess uncertainty in a newly discovered gas field.

- A case study analyzing the impact of different production strategies on the 2P reserves of a shale gas play.

These case studies would provide valuable insights into the practical application of 2P reserve estimation techniques and demonstrate how different factors influence the outcome. Note that due to the confidentiality surrounding commercial data, specific details of case studies often need to be anonymized.

- Behind Pipe Reserves Réserves derrière le tubage :…

- Demonstrated Reserves Décrypter les réserves démont…

- Developed Reserves (reservoir) Réserves développées : La sou…

- Discovered (reserves) "Réserves Découvertes" dans l…

- Non-Producing Reserves Libérer le potentiel : Compre…

- PDNP (reserves) Réserves PDNP : Les géants si…

- PD (reserves) Comprendre les réserves PD (D…

- Possible Reserves (3P) Les 3P de l'ingénierie des ré…

- Probable Reserves Plonger dans le domaine des r…

- Proved Developed Reserves Libérer le potentiel : Les ré…

- Proved Reserves Comprendre les Réserves Prouv…

- Proved Undeveloped Reserves Réserves prouvées non dévelop…

- Proven Reserves (1P) Débloquer le réservoir : comp…

- PUD (reserves) PUD (Réserves) : Comprendre l…

- Recoverable Reserves Débloquer l'avenir : Plongez …

- Contracted Reserves Réserves contractuelles : Un …

- Dry Gas (reserves) Gaz sec : La machine à gaz ma…

- Entitlement (reserves/production) Droits d'exploitation (Réserv…

- Managerial Reserves Réserves de gestion : le file…

- Possible Reserves Débloquer le potentiel : Comp…

- Demande de justification des dépenses Naviguer dans la de… Planification et ordonnancement du projet

- Coût budgété du travail planifié Comprendre le Coût … Estimation et contrôle des coûts

- Les limites de batterie Comprendre les limi… Termes techniques généraux

- Outil DV Outil DV : Un éléme… Forage et complétion de puits

- SOMMAIRE TOC : Comprendre le… Termes techniques généraux

Comments