هندسة المكامن

Possible Reserves (3P)

أساسيات هندسة الخزانات: دليل لفهم احتياطيات النفط والغاز

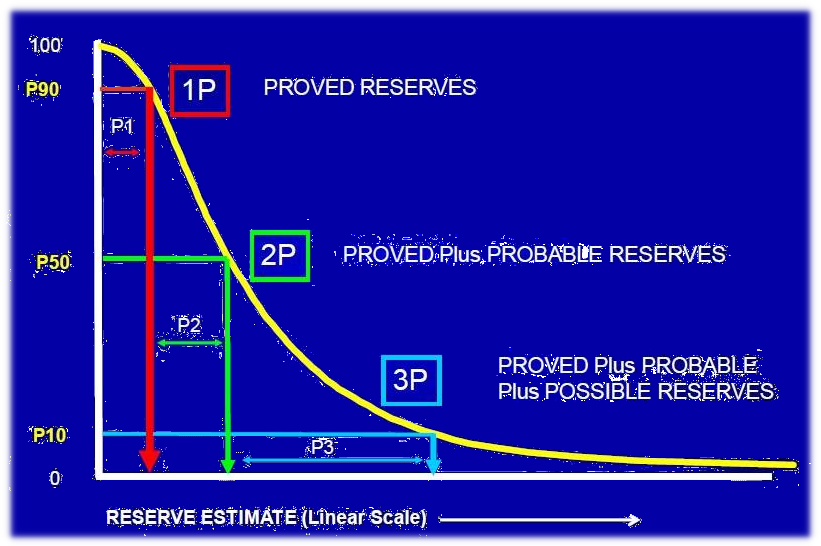

في عالم النفط والغاز، يعتبر فهم احتياطيات الشركة أمراً حيوياً للمستثمرين ومهنيي الصناعة. تمثل هذه الاحتياطيات الأرباح المستقبلية المحتملة للشركة، وتُصنف إلى ثلاثة أنواع رئيسية: **المثبتة (1P)، والمحتملة (2P)، والممكنة (3P)**.

تُستخدم هذه الفئات، المعروفة مجتمعة باسم **3P**، لتقدير كمية الهيدروكربونات التي يمكن استخراجها اقتصاديًا من الخزان. تعتمد هذه الفئات على مجموعة من البيانات الجيولوجية والهندسية والاقتصادية، وتنخفض درجة الثقة في تقديرها مع كل فئة.

1. الاحتياطيات المثبتة (1P):

- التعريف: تمثل هذه الفئة أعلى مستوى من الثقة في تقدير كمية الهيدروكربونات التي يمكن استخراجها من الخزان.

- المعايير: الاحتياطيات المثبتة هي تلك التي تم إثباتها بواسطة الحفر والإنتاج، أو بأدلة موثوقة أخرى، قابلة للاسترداد في المستقبل في ظل الظروف الاقتصادية والتشغيلية الحالية.

- الأهمية: تستخدم الشركات الاحتياطيات المثبتة (1P) للتخطيط لإنتاجها وتوقعاتها المالية، وهي عادةً العامل الأكثر أهمية في تقييم ربحية الشركة.

2. الاحتياطيات المحتملة (2P):

- التعريف: تمثل هذه الفئة مستوى أقل من اليقين من الاحتياطيات المثبتة، لكنها تشير مع ذلك إلى توقع معقول للاسترداد.

- المعايير: الاحتياطيات المحتملة هي تلك التي أقل يقينًا من الاحتياطيات المثبتة ولكن يُنظر إليها بأنها لديها فرصة معقولة للاسترداد.

- الأهمية: تعتبر الاحتياطيات المحتملة إضافة محتملة لإنتاج الشركة، ويمكن استخدامها لاتخاذ قرارات التخطيط طويلة الأجل.

3. الاحتياطيات الممكنة (3P):

- التعريف: تمثل هذه الفئة أدنى مستوى من اليقين في نظام 3P، وتشمل الموارد التي قد تكون قابلة للاسترداد في ظل ظروف مستقبلية مواتية.

- المعايير: الاحتياطيات الممكنة هي تلك التي أقل يقينًا من الاحتياطيات المحتملة، ولديها فرصة أقل للاسترداد.

- الأهمية: تعتبر الاحتياطيات الممكنة تخمينية ولا تُستخدم عادةً لأغراض التخطيط أو الإبلاغ المالي. ومع ذلك، يمكن أن تكون مهمة لتقييم إمكانات الخزان على المدى الطويل.

ملخص:

يوفر نظام 3P إطارًا لفهم اليقين المرتبط بأنواع مختلفة من الاحتياطيات. بينما تعتبر الاحتياطيات المثبتة هي المؤشر الأكثر موثوقية للإنتاج المستقبلي، تقدم الاحتياطيات المحتملة والممكنة رؤىً حول النمو والفرص المستقبلية المحتملة. من خلال فهم نظام 3P، يمكن للمستثمرين ومهنيي الصناعة اتخاذ قرارات أكثر استنارةً حول شركات النفط والغاز وإمكاناتها للنجاح في المستقبل.

ملاحظة مهمة: من المهم أن نتذكر أن تقديرات الاحتياطيات عرضة للتغير مع توفر معلومات جديدة. لذلك، من المهم الاعتماد على مصادر موثوقة وفهم الافتراضات التي تدعم أي تقديرات للاحتياطيات.

Test Your Knowledge

Quiz: The 3P's of Reservoir Engineering

Instructions: Choose the best answer for each question.

1. Which of the following categories represents the highest level of confidence in estimating recoverable hydrocarbons?

a) Probable Reserves (2P)

Answer

Incorrect

b) Possible Reserves (3P)

Answer

Incorrect

c) Proved Reserves (1P)

Answer

Correct

d) None of the above

Answer

Incorrect

2. What is the main difference between Proved Reserves (1P) and Probable Reserves (2P)?

a) Probable Reserves (2P) are more certain than Proved Reserves (1P).

Answer

Incorrect

b) Probable Reserves (2P) represent resources that have been demonstrated by drilling and production.

Answer

Incorrect

c) Proved Reserves (1P) are considered more speculative than Probable Reserves (2P).

Answer

Incorrect

d) Proved Reserves (1P) are more certain than Probable Reserves (2P).

Answer

Correct

3. Which of the following is NOT a criterion for classifying reserves as Proved (1P)?

a) Recoverability under existing economic and operating conditions.

Answer

Incorrect

b) Demonstration by drilling and production.

Answer

Incorrect

c) Reasonable chance of being recovered.

Answer

Correct

d) Reliable evidence supporting recoverability.

Answer

Incorrect

4. What is the significance of Possible Reserves (3P) for an oil and gas company?

a) They are used for long-term planning and financial reporting.

Answer

Incorrect

b) They represent a company's most important asset for profitability.

Answer

Incorrect

c) They are a speculative indicator of potential future growth and opportunities.

Answer

Correct

d) They are used to determine a company's production and financial forecasts.

Answer

Incorrect

5. What is a crucial factor to remember when analyzing reserve estimates?

a) Reserves estimates are always static and never change.

Answer

Incorrect

b) Reserves estimates are based solely on economic data.

Answer

Incorrect

c) Reserves estimates are subject to change with new information.

Answer

Correct

d) Reserves estimates are always 100% accurate.

Answer

Incorrect

Exercise: Analyzing Reserve Data

Scenario: An oil and gas company reports the following reserve data:

- Proved Reserves (1P): 100 million barrels

- Probable Reserves (2P): 50 million barrels

- Possible Reserves (3P): 25 million barrels

Task:

- Calculate the company's total estimated reserves (3P).

- Explain the significance of each reserve category for the company's future.

- Discuss the potential impact of new information on the reserve estimates.

Exercise Correction:

Exercice Correction

1. Total Estimated Reserves (3P): 100 million barrels (1P) + 50 million barrels (2P) + 25 million barrels (3P) = 175 million barrels

2. Significance of Each Reserve Category: * Proved Reserves (1P): This is the most reliable indicator of the company's current production and profitability. * Probable Reserves (2P): This category represents potential future growth and indicates the possibility of expanding production in the future. * Possible Reserves (3P): This category is speculative and highlights potential long-term opportunities, but it's important to note that these reserves may not be recoverable.

3. Impact of New Information: New geological data, exploration results, or changes in economic conditions can significantly impact reserve estimates. For example, a successful exploration well could lead to an increase in Proved Reserves (1P), while a decline in oil prices could affect the economic viability of recovering Probable or Possible Reserves. It's crucial to stay updated on new information and re-evaluate reserve estimates accordingly.

Books

- Petroleum Engineering Handbook by Tarek Ahmed: This comprehensive handbook provides detailed information about reservoir engineering, including reserve estimation methods and classification.

- Reservoir Engineering Handbook by John Lee: Another detailed handbook covering reservoir engineering principles, including a chapter dedicated to reserve estimation and classification.

- Petroleum Reservoir Economics by Michael E. Craft and James F. Hawkins: This book focuses on the economic aspects of oil and gas reserves, including the valuation of different reserve categories.

Articles

- "A Guide to Oil and Gas Reserves Classification" by SPE (Society of Petroleum Engineers): Provides a clear explanation of the 3P system and its application in the industry.

- "Understanding Oil and Gas Reserves: A Primer for Investors" by Investopedia: A beginner-friendly article explaining the different reserve categories and their importance for investors.

- "Reserves Classification and the 3P System" by The American Association of Petroleum Geologists (AAPG): This article delves deeper into the technical details of the 3P system and its use in reserve estimation.

Online Resources

- SPE (Society of Petroleum Engineers): The SPE website offers various resources on reserve estimation, including technical papers, guidelines, and training materials.

- AAPG (American Association of Petroleum Geologists): The AAPG website provides insights into the geology and engineering aspects of oil and gas reserves, including the 3P system.

- EIA (U.S. Energy Information Administration): The EIA website publishes data and reports on oil and gas reserves, providing valuable information for investors and industry professionals.

Search Tips

- "Oil and gas reserves classification": A general search for information on the 3P system.

- "Possible reserves definition": To find specific information on the definition and characteristics of possible reserves.

- "3P reserves estimation methods": To learn about the different techniques used to estimate possible reserves.

- "Company name + reserve report": To access reserve reports published by specific oil and gas companies.

- "SPE + reserves" or "AAPG + reserves": To find relevant resources on reserve estimation from reputable industry organizations.

Techniques

Chapter 1: Techniques for Estimating Possible Reserves (3P)

This chapter delves into the techniques employed to estimate Possible Reserves (3P). Unlike Proved (1P) and Probable (2P) reserves, which rely on established data, estimating 3P reserves necessitates a more speculative approach.

1. Analogue Studies:

- Utilizing data from similar reservoirs with proven production, an analogue study attempts to predict the behavior of the target reservoir.

- Key factors include geological similarities, reservoir characteristics, and production history of the analogue.

- This technique is particularly helpful when limited data is available for the target reservoir.

2. Volumetric Calculations:

- This method relies on estimating the volume of hydrocarbons in the reservoir using geological data.

- Factors like reservoir size, porosity, permeability, and hydrocarbon saturation are factored in.

- However, the accuracy of volumetric calculations is limited by the uncertainty associated with these parameters.

3. Decline Curve Analysis:

- This method analyzes production data from existing wells to predict future production rates.

- By extrapolating historical trends, one can estimate the potential recovery from undrilled areas within the reservoir.

- The reliability of this technique depends heavily on the quality and duration of historical production data.

4. Geostatistical Simulation:

- This technique employs statistical methods to create multiple realizations of the reservoir model, accounting for uncertainties in geological parameters.

- By generating numerous scenarios, it allows for a probabilistic assessment of the potential recovery.

- Requires sophisticated software and extensive data for accurate representation.

5. Reservoir Simulation:

- Advanced simulation software is used to model the fluid flow and production behavior of the reservoir.

- This technique can incorporate various geological and engineering parameters, providing a more comprehensive understanding of the reservoir dynamics.

- While powerful, it necessitates substantial data input and computational resources.

Limitations:

- Uncertainty: Estimating 3P reserves involves inherent uncertainty due to limited data and speculative assumptions.

- Economic Constraints: 3P reserves are often contingent on future economic factors, making estimations subject to volatility.

- Technology Advancement: Advancements in technology can impact the recoverability of reserves, making historical estimations prone to change.

Conclusion:

Estimating Possible Reserves (3P) requires a combination of established techniques and speculative considerations. While uncertainty is inherent in the process, the above-mentioned techniques provide valuable insights into the long-term potential of a reservoir. Understanding the limitations of each technique is crucial for accurate assessment and decision-making.

Chapter 2: Models for Estimating Possible Reserves (3P)

This chapter explores various models utilized to estimate Possible Reserves (3P), considering their strengths, limitations, and applications.

1. Deterministic Models:

- Fixed Values: These models use fixed values for geological and engineering parameters, resulting in a single estimate of the reserves.

- Example: Volumetric calculations, where parameters like porosity and saturation are assigned specific values.

- Advantages: Simplicity and ease of implementation.

- Limitations: Limited ability to account for uncertainties and potential variability in the reservoir.

2. Probabilistic Models:

- Uncertainty Distribution: These models account for uncertainties in geological parameters by assigning probability distributions to them.

- Monte Carlo Simulation: A common probabilistic approach, where multiple simulations are run with random values drawn from the assigned distributions.

- Advantages: Provides a range of possible outcomes, reflecting the inherent uncertainty in estimations.

- Limitations: Requires extensive data and sophisticated software for implementation.

3. Hybrid Models:

- Combination of Techniques: These models combine deterministic and probabilistic approaches to leverage the strengths of both.

- Example: Combining volumetric calculations with probabilistic simulations to account for uncertainty in key parameters.

- Advantages: Offers a balanced approach, incorporating both specific data and probabilistic estimations.

- Limitations: Can be complex and require careful consideration of data availability and model parameters.

4. Dynamic Models:

- Reservoir Simulation: These models simulate the dynamic behavior of the reservoir over time, considering fluid flow, production rates, and reservoir depletion.

- Advantages: Provides a more realistic representation of reservoir performance, accounting for factors like reservoir pressure and well interference.

- Limitations: Require extensive data, computational resources, and advanced software for implementation.

Choice of Model:

The selection of an appropriate model for 3P estimation depends on factors like:

- Data availability: Probabilistic models require more data than deterministic models.

- Complexity of the reservoir: Dynamic models are better suited for complex reservoirs with significant fluid flow.

- Desired level of uncertainty: Probabilistic models provide a more comprehensive assessment of uncertainty.

Conclusion:

Selecting and applying the appropriate model for 3P estimation is crucial for obtaining accurate and reliable estimates. Understanding the strengths and limitations of different models allows for informed decision-making and risk assessment.

Chapter 3: Software for Possible Reserves (3P) Estimation

This chapter provides an overview of software commonly used for estimating Possible Reserves (3P). These software solutions offer a range of functionalities, from basic calculations to sophisticated simulations.

1. General Purpose Software:

- Excel: Widely used for basic calculations and data analysis, including volumetric estimations.

- MATLAB: A powerful tool for mathematical modeling and statistical analysis, suitable for more complex calculations.

- Python: A versatile programming language with various libraries for data analysis, statistical modeling, and visualization.

2. Specialized Software:

- Petrel: A comprehensive software suite for geological modeling, reservoir simulation, and production forecasting.

- Eclipse: Industry-standard software for reservoir simulation, capable of handling complex reservoir dynamics.

- Gem: A user-friendly software for reservoir simulation, offering an intuitive interface and robust modeling capabilities.

- Interwell: A specialized software for well performance analysis and production forecasting.

- WellCAD: Software focused on well design and optimization, aiding in production planning and reserve estimation.

Features:

- Geological Modeling: Create 3D models of the reservoir, including structural features, lithology, and fluid properties.

- Reservoir Simulation: Simulate fluid flow and production behavior, considering factors like reservoir pressure and well interference.

- Production Forecasting: Estimate future production rates and cumulative recovery based on the simulated results.

- Economic Evaluation: Perform economic analysis, incorporating production costs and oil/gas prices.

Considerations:

- Cost: Specialized software can be expensive, requiring licensing fees and potentially ongoing maintenance.

- Training: Many software packages require extensive training for users to master the complex functionalities.

- Data Requirements: Software often requires large datasets for accurate modeling, posing challenges for projects with limited data availability.

Conclusion:

The choice of software for 3P estimation depends on the project's specific needs, budget, and available data. While general purpose software can be useful for basic calculations, specialized software provides advanced functionalities for complex reservoir simulations and production forecasting. It is essential to choose software that aligns with the project requirements and expertise of the team.

Chapter 4: Best Practices for Possible Reserves (3P) Estimation

This chapter focuses on best practices for ensuring robust and reliable estimations of Possible Reserves (3P). Following these guidelines enhances the accuracy and transparency of the estimation process.

1. Data Quality and Availability:

- Comprehensive Data Collection: Gather all available data, including geological, geophysical, well logs, production history, and reservoir characteristics.

- Data Validation: Thoroughly validate the accuracy and consistency of data before using it for estimations.

- Data Gaps: Identify and address data gaps through data acquisition, interpolation, or expert judgment.

2. Model Selection and Validation:

- Appropriate Model Selection: Choose a model that aligns with the complexity of the reservoir and the available data.

- Model Validation: Validate the selected model using historical data and comparing results with analogous reservoirs.

- Sensitivity Analysis: Assess the impact of uncertain parameters on the results through sensitivity analysis.

3. Transparency and Documentation:

- Detailed Documentation: Maintain thorough documentation of the assumptions, methods, and data used for the estimations.

- Clear Reporting: Present results in a clear and concise manner, including uncertainties and limitations.

- Peer Review: Seek peer review by qualified professionals to enhance the credibility and robustness of the estimations.

4. Continuous Evaluation and Updates:

- Regular Monitoring: Monitor production performance and compare it with the estimations.

- Adaptive Updates: Update the estimations as new data becomes available and reservoir understanding improves.

- Industry Standards: Adhere to industry standards for reserve estimation, ensuring consistency and comparability.

5. Considerations for Economic Factors:

- Current and Future Prices: Incorporate current and projected oil/gas prices into economic analysis.

- Operating Costs: Account for operating costs, including production, transportation, and processing.

- Regulatory Framework: Consider the regulatory environment and potential impact on production and profitability.

Conclusion:

By adhering to these best practices, companies can increase the reliability and transparency of Possible Reserves (3P) estimations. A robust estimation process helps to make informed decisions, attract investment, and manage production effectively.

Chapter 5: Case Studies of Possible Reserves (3P) Estimation

This chapter presents real-world case studies showcasing the application of different techniques and models for estimating Possible Reserves (3P). These case studies highlight the practical implementation of concepts discussed in previous chapters.

Case Study 1: Shale Gas Reservoir

- Challenge: Estimating 3P reserves in a newly discovered shale gas reservoir with limited production history.

- Method: Combining analogue studies, volumetric calculations, and decline curve analysis to assess the potential recovery.

- Outcome: The estimations provided a range of possible recovery scenarios, highlighting the uncertainties associated with a new field.

- Key Takeaway: Demonstrates the importance of utilizing multiple techniques to address data limitations and evaluate potential risks.

Case Study 2: Offshore Oil Field

- Challenge: Estimating 3P reserves for a mature offshore oil field undergoing secondary recovery operations.

- Method: Implementing reservoir simulation with probabilistic models to account for uncertainties in recovery factors and reservoir pressure.

- Outcome: The study provided a range of possible recovery scenarios, highlighting the potential impact of different production strategies.

- Key Takeaway: Emphasizes the value of reservoir simulation for complex reservoirs, enabling analysis of different scenarios and optimization of production strategies.

Case Study 3: Geothermal Energy Project

- Challenge: Estimating the potential geothermal resources for a proposed power plant.

- Method: Using geostatistical simulations and volumetric calculations to estimate the size and temperature of the geothermal reservoir.

- Outcome: The estimations provided a basis for feasibility analysis and investment decisions.

- Key Takeaway: Illustrates the application of 3P estimation techniques for unconventional resources, highlighting the need for specific considerations and models.

Conclusion:

These case studies demonstrate the diverse applications of Possible Reserves (3P) estimation techniques across different types of oil and gas reservoirs and energy projects. Understanding the specific challenges and methods employed in these case studies provides valuable insights for practical application.

By learning from these real-world examples, industry professionals can apply best practices and leverage appropriate tools for accurate and reliable estimations, enabling informed decision-making and successful project execution.

- As-Late-As-Possible ("ALAP") جدولة "أخر ما يمكن" (ALAP): ت…

- As-Soon-As-Possible ("ASAP") "ASAP": مصطلح تقني مفسر في…

- Behind Pipe Reserves احتياطيات خلف الأنابيب: استخر…

- Demonstrated Reserves فك رموز الاحتياطيات المؤكدة: …

- Developed Reserves (reservoir) الاحتياطيات المطورة: مصدر موث…

- Discovered (reserves) "الاحتياطيات المكتشفة" في الن…

- Non-Producing Reserves كشف الإمكانات: فهم الاحتياطيا…

- PDNP (reserves) احتياطيات PDNP: العملاقان الص…

- PD (reserves) فهم احتياطيات PD (المُطوّرة) …

- Probable Reserves الغوص في عالم الاحتياطيات الم…

- Probable Reserves (2P) كشف الإمكانات: احتياطيات 2P ف…

- Proved Developed Reserves كشف الإمكانات: احتياطيات مُثب…

- Proved Reserves فهم الاحتياطيات المؤكدة: أساس…

- Proved Undeveloped Reserves الاحتياطيات المثبتة غير المطو…

- Proven Reserves (1P) فك رموز الخزان: فهم 1P في هند…

- Contracted Reserves الاحتياطيات المتعاقد عليها: ح…

- Dry Gas (reserves) الغاز الجاف: آلة الطاقة النحي…

- Entitlement (reserves/production) حق الانتفاع (الاحتياطيات/الإن…

- Managerial Reserves الاحتياطيات الإدارية: شبكة ال…

- Possible Reserves كشف الإمكانات: فهم "الاحتياطي…

- طلب تبرير المصروفات طلب مبرر الإنفاق: د… تخطيط وجدولة المشروع

- التكلفة الميزانية للعمل المجدول فهم تكلفة العمل الم… تقدير التكلفة والتحكم فيها

- حدود البطارية فهم حدود البطارية ف… المصطلحات الفنية العامة

- أداة الصمام السفلي أداة الصمام السفلي:… الحفر واستكمال الآبار

- جدول المحتويات TOC: فهم قمة الإسمن… المصطلحات الفنية العامة

Comments