هندسة المكامن

Probable Reserves (2P)

كشف الإمكانات: احتياطيات 2P في النفط والغاز

في عالم استكشاف وإنتاج النفط والغاز، من الضروري فهم تقديرات الموارد. أحد المصطلحات الرئيسية المستخدمة في هذه الصناعة هو "احتياطيات 2P"، وهو مصطلح يُصادف كثيرًا في التقارير والعروض التقديمية. تهدف هذه المقالة إلى فك شيفرة مفهوم احتياطيات 2P، مُسلطة الضوء على أهميتها وكيفية اختلافها عن فئات الموارد الأخرى.

ما هي احتياطيات 2P؟

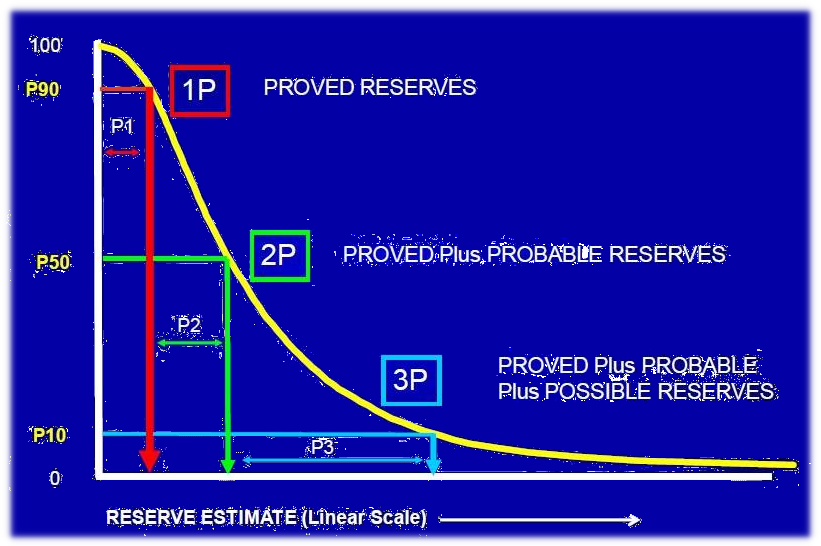

تمثل احتياطيات 2P، المعروفة أيضًا باسم "احتياطيات مؤكدة بالإضافة إلى محتملة"، الكمية المُقدرة من النفط أو الغاز التي يُعتقد أنها من المحتمل جدًا أن تكون قابلة للاسترداد في ظل الظروف الاقتصادية والتشغيلية الحالية. تشمل هذه الفئة عنصرين رئيسيين:

- احتياطيات مؤكدة (1P): هذه هي الاحتياطيات التي تتمتع بدرجة عالية من اليقين. تستند إلى بيانات حفر واختبار واسعة النطاق، مما يشير إلى أن الاستخراج ممكن تقنيًا ومُجدٍ تجاريًا.

- احتياطيات محتملة (2P): تتمتع هذه الاحتياطيات بدرجة أقل من اليقين مقارنة بالاحتياطيات المؤكدة. بينما توجد أدلة جيولوجية وهندسية قوية لدعم وجودها، قد يكون هناك بعض عدم اليقين بشأن حجمها الدقيق أو قابلية استردادها.

فهم الفرق:

من الضروري التمييز بين احتياطيات 2P وفئات الموارد الأخرى مثل:

- احتياطيات محتملة (3P): تتمتع هذه الاحتياطيات بدرجة أقل من اليقين من الاحتياطيات المحتملة. تعتمد على بيانات أقل حسمًا، وقد تكون مُشروطة بتطورات تقنية محددة أو ظروف سوقية مستقبلية.

- موارد مشروطة: هذه هي الموارد التي يمكن استردادها بشكل محتمل، ولكنها تتطلب إجراءات محددة، مثل الموافقات التنظيمية أو ارتفاع الأسعار، لأن تصبح مُجدية اقتصاديًا.

أهمية احتياطيات 2P:

تُعتبر احتياطيات 2P ذات أهمية كبيرة لمختلف أصحاب المصلحة في صناعة النفط والغاز:

- المستثمرون: تُقدم احتياطيات 2P مؤشرًا قويًا على الربحية المحتملة للشركة والإيرادات المستقبلية. غالبًا ما تُستخدم لتقييم قيمة شركة نفط وغاز.

- المُقرضون: تستخدم البنوك والمقرضون الآخرون احتياطيات 2P لتقييم جدوى ائتمان شركات النفط والغاز التي تسعى للحصول على تمويل.

- الحكومات: تعتمد الحكومات على احتياطيات 2P لمراقبة توافر الموارد، والتخطيط لإنتاج الطاقة المستقبلي، وإدارة الإتاوات.

قيود احتياطيات 2P:

بينما تُقدم احتياطيات 2P رؤى قيمة، من المهم أن تكون على دراية بقيودها:

- التقديرات مبنية على الظروف الحالية: تُقدّر احتياطيات 2P بناءً على الظروف الاقتصادية والتكنولوجية السائدة. يمكن أن تؤثر التغييرات في هذه العوامل على الكمية الفعلية للموارد القابلة للاسترداد.

- عدم اليقين متأصل: حتى مع وجود أدلة قوية، لا يزال هناك قدر من عدم اليقين المرتبط باحتياطيات 2P. قد تؤدي الاكتشافات الجيولوجية الجديدة أو التطورات التكنولوجية إلى تغيير الكمية المُقدرة.

الاستنتاج:

تلعب احتياطيات 2P دورًا بالغ الأهمية في صناعة النفط والغاز. يساعد فهم هذا المفهوم المستثمرين والمُقرضين والحكومات على اتخاذ قرارات مُستنيرة. بينما تُقدم هذه التقديرات صورة قيمة عن إمكانات موارد الشركة، من الضروري الاعتراف بأنها قابلة للتغيير بناءً على ديناميكيات السوق المتطورة والتقدم التكنولوجي.

Test Your Knowledge

Quiz: Unlocking the Potential: 2P Reserves in Oil & Gas

Instructions: Choose the best answer for each question.

1. What does "2P reserves" stand for? a) Proved plus probable reserves b) Potential plus probable reserves c) Possible plus probable reserves d) Proved plus possible reserves

Answer

a) Proved plus probable reserves

2. Which of the following is NOT included in 2P reserves? a) Proved reserves b) Probable reserves c) Possible reserves d) Contingent resources

Answer

c) Possible reserves

3. What is the main difference between proved and probable reserves? a) Proved reserves are based on less conclusive data than probable reserves. b) Probable reserves have a higher degree of certainty than proved reserves. c) Proved reserves have a higher degree of certainty than probable reserves. d) There is no difference between proved and probable reserves.

Answer

c) Proved reserves have a higher degree of certainty than probable reserves.

4. Which stakeholder group uses 2P reserves to assess a company's creditworthiness? a) Investors b) Lenders c) Governments d) Consumers

Answer

b) Lenders

5. What is a major limitation of 2P reserves? a) They are always accurate and unchanging. b) They only consider technological factors, not economic ones. c) They are based on current conditions, which can change. d) They are not useful for decision-making.

Answer

c) They are based on current conditions, which can change.

Exercise: 2P Reserves Analysis

Scenario: An oil and gas company reports the following resource estimates:

- Proved Reserves: 100 million barrels

- Probable Reserves: 50 million barrels

- Possible Reserves: 20 million barrels

- Contingent Resources: 30 million barrels

Task:

- Calculate the company's total 2P reserves.

- Explain why the company's contingent resources are not included in the 2P reserve calculation.

Exercice Correction

1. **Total 2P reserves:** Proved Reserves + Probable Reserves = 100 million barrels + 50 million barrels = **150 million barrels** 2. **Contingent resources are not included in 2P reserves because they are not considered highly likely to be recoverable under current economic and operating conditions.** They require specific actions like regulatory approvals or price increases to become economically viable, making them less certain than proved or probable reserves.

Books

- Petroleum Resources Management System (PRMS): This book, published by the Society of Petroleum Engineers (SPE), provides a comprehensive overview of the PRMS, including detailed explanations of 2P reserves and other resource categories.

- Oil and Gas Economics: A Guide for the Professional: Written by James S. Lee, this book covers various aspects of oil and gas economics, including reserve estimation and valuation, which will shed light on the importance of 2P reserves.

- Petroleum Engineering Handbook: Edited by William C. Lyons, this handbook offers a detailed explanation of oil and gas production processes, including reserve estimation techniques and the concept of 2P reserves.

Articles

- "Understanding Oil and Gas Reserve Categories" by the U.S. Energy Information Administration (EIA): This article provides a clear and concise explanation of the different reserve categories, including 2P reserves, and their importance in the oil and gas industry.

- "The Difference Between Proved, Probable, and Possible Reserves" by Investopedia: This article highlights the distinctions between different reserve categories and explains how they are used in financial reporting and investment decisions.

- "Reserve Definitions & Standards" by the Society of Petroleum Engineers (SPE): This article provides a detailed overview of the SPE's reserve definitions and standards, including the criteria for classifying reserves as 2P.

Online Resources

- Society of Petroleum Engineers (SPE): The SPE website offers a vast library of resources related to oil and gas exploration and production, including articles, publications, and educational materials on reserve estimation and 2P reserves.

- U.S. Energy Information Administration (EIA): The EIA website provides extensive data and analysis on energy markets, including information on oil and gas reserves, production, and consumption.

- World Energy Council (WEC): The WEC website offers a global perspective on energy issues, including resources, technology, and policy. They have valuable resources on oil and gas reserves and their role in global energy supply.

Search Tips

- Use precise keywords like "2P reserves definition", "2P reserves vs 1P reserves", "2P reserves in oil and gas industry", "probable reserves calculation".

- Combine keywords with specific company names or regions, like "ExxonMobil 2P reserves" or "2P reserves in the North Sea".

- Use quotation marks around specific phrases to refine your search, like "proved plus probable reserves".

- Include relevant websites or organizations in your search, like "site:spe.org 2P reserves".

Techniques

Unlocking the Potential: 2P Reserves in Oil & Gas

This expanded document delves deeper into the concept of 2P (Proved Plus Probable) reserves, breaking down the topic into distinct chapters for clarity.

Chapter 1: Techniques for Estimating Probable Reserves

Estimating probable reserves (2P) relies on a combination of geological, geophysical, and engineering data. The process isn't a simple calculation but a complex evaluation incorporating uncertainty. Key techniques include:

Geological Modeling: This involves creating 3D representations of the subsurface, incorporating data from seismic surveys, well logs, core samples, and geological interpretations. The model predicts the distribution of reservoir rock, its properties (porosity, permeability), and the presence of hydrocarbons. Uncertainty is quantified through multiple realizations of the model, each representing a plausible geological scenario.

Reservoir Simulation: Once a geological model is built, reservoir simulation software is used to predict fluid flow and hydrocarbon recovery under various operating conditions. This helps determine the recoverable volume of hydrocarbons under different scenarios, incorporating uncertainties related to reservoir pressure, fluid properties, and production techniques.

Material Balance Calculations: These calculations use historical production data and reservoir pressure measurements to estimate the original hydrocarbon in place and the remaining reserves. This method is most effective in mature fields with a long history of production.

Analogue Studies: Comparing the reservoir under investigation to similar, already-produced fields can provide insights into potential recovery factors and reservoir performance. This technique is particularly useful in early exploration stages when data is limited.

Statistical Analysis: Uncertainty quantification is crucial in 2P reserve estimations. Statistical methods, such as Monte Carlo simulations, are employed to account for uncertainties in input parameters (e.g., porosity, permeability, recovery factor) and generate a probability distribution of possible reserve volumes. This allows for the assignment of probabilities to different reserve levels (e.g., P10, P50, P90).

Chapter 2: Models Used in 2P Reserve Estimation

Various models are used to estimate 2P reserves, each with its strengths and limitations. The choice of model depends on the available data, the reservoir characteristics, and the level of uncertainty.

Deterministic Models: These models use single best-estimate values for input parameters. While simpler to use, they fail to capture the inherent uncertainties associated with reservoir characterization.

Probabilistic Models: These models account for uncertainty by using probability distributions for input parameters. Monte Carlo simulations are frequently used to generate a range of possible reserve estimates, providing a more realistic representation of the uncertainty.

Geostatistical Models: These models use spatial statistics to interpolate data from well locations to create continuous reservoir property maps. Kriging and sequential Gaussian simulation are common geostatistical techniques used in reservoir modeling.

Dynamic Models: Reservoir simulation models are dynamic models that predict fluid flow and pressure changes over time. These models are crucial for assessing the impact of different production strategies on recoverable reserves.

Chapter 3: Software for 2P Reserve Estimation

Specialized software packages are used to perform the complex calculations and simulations involved in 2P reserve estimation. These packages integrate various functionalities required for geological modeling, reservoir simulation, and uncertainty analysis. Examples include:

Petrel (Schlumberger): A widely used integrated reservoir modeling and simulation platform.

Eclipse (Schlumberger): A powerful reservoir simulator used for predicting hydrocarbon production and recovery.

CMG (Computer Modelling Group): Another popular reservoir simulation suite offering various functionalities.

RMS (Roxar): Provides tools for reservoir characterization, simulation, and production forecasting.

These software packages often incorporate functionalities for data management, visualization, and reporting, aiding in the efficient and accurate estimation of 2P reserves.

Chapter 4: Best Practices in 2P Reserve Estimation

Adhering to best practices ensures the reliability and credibility of 2P reserve estimates. Key best practices include:

Data Quality Control: Accurate and reliable data is crucial. Rigorous data validation and quality control are essential before any modeling or simulation is undertaken.

Independent Audits: Independent audits of reserve estimates are often required by regulatory bodies and investors to ensure transparency and objectivity.

Transparency and Documentation: The entire reserve estimation process should be well-documented, including data sources, assumptions made, and methodologies used.

Use of Qualified Professionals: Reserve estimation should be conducted by qualified petroleum engineers and geologists with extensive experience in the field.

Compliance with Industry Standards: Following industry standards like those published by the Society of Petroleum Engineers (SPE) ensures consistency and comparability of reserve estimates.

Chapter 5: Case Studies of 2P Reserve Estimation

Case studies illustrate how 2P reserves are estimated in real-world scenarios. These studies demonstrate the application of the techniques and models discussed above, highlighting the challenges and uncertainties encountered. Specific case studies would focus on diverse reservoir types (e.g., conventional, unconventional) and demonstrate how the methodologies were adapted to the specific challenges posed by each case. Examples could include:

- A case study detailing the 2P reserve estimation of a mature oil field using material balance calculations and reservoir simulation.

- A case study showing the use of probabilistic methods to assess uncertainty in a newly discovered gas field.

- A case study analyzing the impact of different production strategies on the 2P reserves of a shale gas play.

These case studies would provide valuable insights into the practical application of 2P reserve estimation techniques and demonstrate how different factors influence the outcome. Note that due to the confidentiality surrounding commercial data, specific details of case studies often need to be anonymized.

- Behind Pipe Reserves احتياطيات خلف الأنابيب: استخر…

- Demonstrated Reserves فك رموز الاحتياطيات المؤكدة: …

- Developed Reserves (reservoir) الاحتياطيات المطورة: مصدر موث…

- Discovered (reserves) "الاحتياطيات المكتشفة" في الن…

- Non-Producing Reserves كشف الإمكانات: فهم الاحتياطيا…

- PDNP (reserves) احتياطيات PDNP: العملاقان الص…

- PD (reserves) فهم احتياطيات PD (المُطوّرة) …

- Possible Reserves (3P) أساسيات هندسة الخزانات: دليل …

- Probable Reserves الغوص في عالم الاحتياطيات الم…

- Proved Developed Reserves كشف الإمكانات: احتياطيات مُثب…

- Proved Reserves فهم الاحتياطيات المؤكدة: أساس…

- Proved Undeveloped Reserves الاحتياطيات المثبتة غير المطو…

- Proven Reserves (1P) فك رموز الخزان: فهم 1P في هند…

- PUD (reserves) احتياطيات PUD (الاحتياطيات): …

- Recoverable Reserves فتح المستقبل: رحلة عميقة في ا…

- Contracted Reserves الاحتياطيات المتعاقد عليها: ح…

- Dry Gas (reserves) الغاز الجاف: آلة الطاقة النحي…

- Entitlement (reserves/production) حق الانتفاع (الاحتياطيات/الإن…

- Managerial Reserves الاحتياطيات الإدارية: شبكة ال…

- Possible Reserves كشف الإمكانات: فهم "الاحتياطي…

- طلب تبرير المصروفات طلب مبرر الإنفاق: د… تخطيط وجدولة المشروع

- التكلفة الميزانية للعمل المجدول فهم تكلفة العمل الم… تقدير التكلفة والتحكم فيها

- حدود البطارية فهم حدود البطارية ف… المصطلحات الفنية العامة

- أداة الصمام السفلي أداة الصمام السفلي:… الحفر واستكمال الآبار

- جدول المحتويات TOC: فهم قمة الإسمن… المصطلحات الفنية العامة

Comments