هندسة المكامن

Proven Reserves (1P)

فك رموز الخزان: فهم 1P في هندسة الخزانات

في عالم النفط والغاز، فإن فهم إمكانات الخزان أمر بالغ الأهمية. أحد المصطلحات الرئيسية المستخدمة في هندسة الخزانات هو **1P**، والذي يشير إلى **الاحتياطيات المؤكدة**. تُناقش هذه المقالة معنى 1P وأهميتها في تحديد الجدوى الاقتصادية للخزان.

ما هي الاحتياطيات المؤكدة (1P)؟

تمثل الاحتياطيات المؤكدة، أو 1P، الكمية المقدرة من الهيدروكربونات التي **يُعتقد أنها قابلة للاستخلاص بدرجة عالية من اليقين**. هذا يعني أن حجم النفط أو الغاز يُعتبر **قابلًا للاستخراج من الناحية الفنية والاقتصادية**، بناءً على التكنولوجيا الحالية وظروف السوق.

تحديد الاحتياطيات المؤكدة:

تتضمن حسابات 1P عملية صارمة من التقييمات الجيولوجية والهندسية. تتضمن العوامل الرئيسية ما يلي:

- البيانات الجيولوجية: تتضمن معلومات حول حجم وشكل الخزان، ونوعية ودقة رواسب الهيدروكربون، ووجود أي حواجز أو مصائد.

- بيانات الإنتاج: يتم تحليل بيانات الإنتاج التاريخية من الآبار الحالية لتقييم أداء الخزان وتقدير الإنتاج المستقبلي.

- التقييمات الهندسية: يقيم المهندسون إمكانية استخراج الهيدروكربونات باستخدام التكنولوجيا الحالية، بما في ذلك تقنيات الحفر والاكتمال والإنتاج.

- الاعتبارات الاقتصادية: يتم أخذ التكلفة المقدرة للإنتاج والنقل والمعالجة في الاعتبار لتحديد الجدوى الاقتصادية لاستخراج الاحتياطيات.

الوصف الموجز للاحتياطيات المؤكدة (1P):

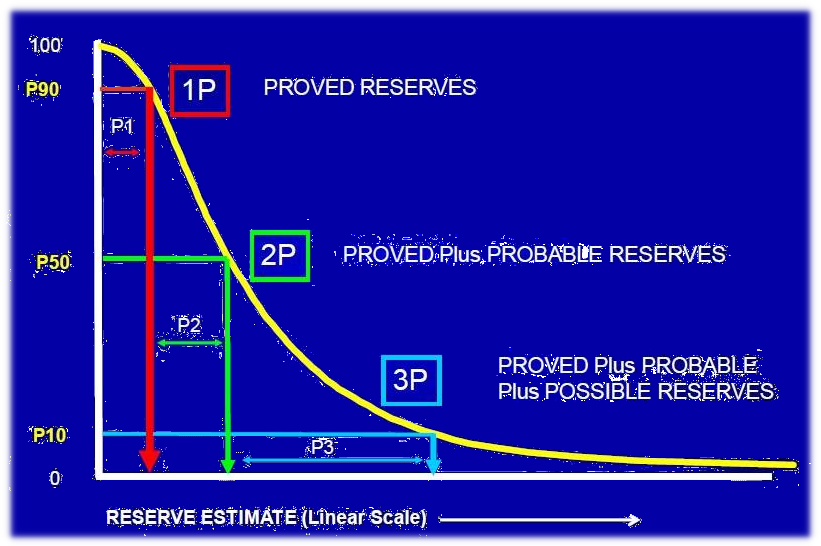

عادةً ما يتم تصنيف الاحتياطيات المؤكدة إلى ثلاثة مستويات:

- 1P (مؤكد): الفئة الأكثر تأكيدًا، والتي تمثل الهيدروكربونات التي تُعتبر "قابلية الإنتاج اقتصاديًا" في ظل الظروف الحالية.

- 2P (مُرجّح): احتياطيات أقل تأكيدًا من 1P لكنها لا تزال من المحتمل أن يتم استردادها. قد تتطلب مزيدًا من التطوير أو قد تتطلب أسعار نفط أعلى قليلاً لكي تصبح قابلة للاسترداد اقتصاديًا.

- 3P (مُحتمل): الفئة الأقل تأكيدًا، والتي تمثل الاحتياطيات التي تُعتبر قابلة للاسترداد من الناحية الفنية ولكنها قد تتطلب تقدمًا تكنولوجيًا كبيرًا أو أسعار نفط أعلى لتصبح قابلة للاسترداد اقتصاديًا.

أهمية الاحتياطيات المؤكدة:

تلعب 1P دورًا حاسمًا في جوانب مختلفة من صناعة النفط والغاز:

- قرارات الاستثمار: تعتمد شركات النفط والغاز بشكل كبير على تقديرات 1P عند اتخاذ قرار بشأن الاستثمار في خزان معين.

- التقييم: تُعد الاحتياطيات المؤكدة عاملًا رئيسيًا في تحديد قيمة شركة نفط وغاز أو أصل معين.

- إدارة الموارد: يسمح فهم الاحتياطيات المؤكدة للشركات بالتخطيط للإنتاج المستقبلي وإدارة مواردها بكفاءة.

- الامتثال التنظيمي: تفرض العديد من الدول لوائح بشأن الإبلاغ عن الاحتياطيات المؤكدة، مما يضمن الشفافية والمساءلة في الصناعة.

الاستنتاج:

تُعد الاحتياطيات المؤكدة (1P) مفهومًا أساسيًا في هندسة الخزانات. تمثل الكمية المقدرة من الهيدروكربونات التي تُعتبر قابلة للاستخلاص بدرجة عالية من اليقين، مما يجعلها عاملًا حاسمًا في قرارات الاستثمار والتقييم وإدارة الموارد في صناعة النفط والغاز. من خلال فهم 1P، يمكن لأصحاب المصلحة الحصول على صورة أوضح للجدوى الاقتصادية وإمكانات الخزان.

Test Your Knowledge

Quiz: Unlocking the Reservoir: Understanding 1P in Reservoir Engineering

Instructions: Choose the best answer for each question.

1. What does the term "1P" represent in reservoir engineering? (a) Possible Reserves (b) Probable Reserves (c) Proven Reserves (d) Potential Reserves

Answer

(c) Proven Reserves

2. What is the main factor that distinguishes 1P from 2P and 3P reserves? (a) The size of the reservoir (b) The quality of the hydrocarbon deposit (c) The certainty of recovery (d) The cost of extraction

Answer

(c) The certainty of recovery

3. Which of the following is NOT a key factor in determining 1P? (a) Geological data (b) Production data (c) Environmental impact assessment (d) Engineering evaluations

Answer

(c) Environmental impact assessment

4. What is the significance of 1P in the oil and gas industry? (a) It helps determine the environmental impact of oil and gas production (b) It is used to estimate the future price of oil and gas (c) It is crucial for investment decisions, valuation, and resource management (d) It helps predict the lifespan of a reservoir

Answer

(c) It is crucial for investment decisions, valuation, and resource management

5. Which statement BEST describes 1P reserves? (a) Reserves that are technically feasible to recover but may require advancements in technology (b) Reserves that are likely to be recovered but may require slightly higher oil prices (c) Reserves that are considered economically producible under current conditions (d) Reserves that are the most uncertain and may never be recovered

Answer

(c) Reserves that are considered economically producible under current conditions

Exercise:

Scenario: An oil company is evaluating a new reservoir for potential investment. They have gathered the following data:

- Geological Data: The reservoir is estimated to contain 500 million barrels of oil.

- Production Data: Existing wells in similar reservoirs produce an average of 10,000 barrels per day for 10 years.

- Engineering Evaluations: The company can access the reservoir using current technology with an estimated recovery rate of 70%.

- Economic Considerations: The cost of production, transportation, and processing is estimated at $40 per barrel. The current market price for oil is $60 per barrel.

Task: Based on the information provided, calculate the 1P reserves for the new reservoir.

Exercice Correction

**1. Calculate the total recoverable oil:** * Estimated oil in the reservoir: 500 million barrels * Recovery rate: 70% * Total recoverable oil: 500 million barrels * 0.70 = 350 million barrels **2. Determine if the reserves are economically viable:** * Cost of production per barrel: $40 * Market price per barrel: $60 * Profit per barrel: $60 - $40 = $20 Since the profit per barrel is positive, the reserves are considered economically viable. **Therefore, the 1P reserves for the new reservoir are estimated to be 350 million barrels.**

Books

- Petroleum Engineering Handbook: This comprehensive handbook, edited by William D. McCain, covers various aspects of reservoir engineering, including reserve estimation and classification.

- Reservoir Engineering Handbook: By Tarek Ahmed, this book provides detailed information on reservoir characterization, fluid flow, well performance, and reserve estimation.

- Fundamentals of Petroleum Engineering: By John C. Dake, this textbook offers a strong foundation in petroleum engineering concepts, including reserve estimation methods.

Articles

- "Understanding Proven, Probable and Possible Reserves" by the Society of Petroleum Engineers (SPE) - This article provides a clear explanation of the different reserve categories, including Proven Reserves (1P).

- "Reserve Estimation: The Role of Technology and Uncertainty" by SPE - This article explores the impact of technology and uncertainty on reserve estimation, highlighting the importance of rigorous analysis.

- "The Changing Landscape of Reserve Reporting" by Oil & Gas Journal - This article discusses the evolving trends in reserve reporting and the role of independent reserve auditors.

Online Resources

- Society of Petroleum Engineers (SPE): SPE's website offers a wealth of resources on reservoir engineering, including publications, technical papers, and industry standards related to reserve estimation.

- American Petroleum Institute (API): API provides guidelines and standards for reserve estimation and reporting, which are widely used in the industry.

- World Oil: This industry publication provides news, analysis, and technical articles related to oil and gas production, including reserve estimation.

Search Tips

- Use specific keywords: When searching for information, use specific keywords like "Proven Reserves", "1P Reserves", "Reserve Estimation", and "Reservoir Engineering".

- Combine keywords: Combine keywords to narrow your search, for example, "Proven Reserves + SPE" or "Reserve Estimation + API Guidelines".

- Use quotation marks: Enclose specific terms in quotation marks to search for exact phrases, such as "Proven Reserves (1P)".

- Explore different file types: Include specific file types in your search, such as "pdf" or "doc", to find relevant documents.

Techniques

Unlocking the Reservoir: Understanding 1P in Reservoir Engineering

This expanded version breaks down the topic of Proven Reserves (1P) into separate chapters.

Chapter 1: Techniques for Estimating Proven Reserves (1P)

Determining Proven Reserves (1P) requires a multidisciplinary approach combining geological, geophysical, and engineering data. Several key techniques are employed:

Material Balance Calculations: This classic technique uses pressure-volume-temperature (PVT) data and reservoir production history to estimate the original hydrocarbon in place and the remaining reserves. It's particularly useful in mature fields with extensive production history. Limitations include assumptions about reservoir homogeneity and fluid properties.

Decline Curve Analysis: This method analyzes the historical production decline rate to predict future production. Different decline curve models (exponential, hyperbolic, harmonic) are used depending on the reservoir characteristics. Accuracy depends on the quality and length of the production history and the applicability of the chosen model to the specific reservoir.

Reservoir Simulation: This sophisticated technique utilizes numerical models to simulate fluid flow and pressure behavior within the reservoir. It incorporates geological data, rock properties, and fluid properties to predict production under various scenarios. While powerful, reservoir simulation requires significant computational resources and expertise, and its accuracy depends on the quality of the input data.

Analogue Studies: This comparative approach uses data from similar reservoirs with known production history to estimate reserves in the reservoir being evaluated. Success depends on finding truly analogous reservoirs, which can be challenging.

Geological Modeling: Building 3D geological models of the reservoir is crucial. These models integrate seismic data, well logs, and core analysis to define reservoir geometry, porosity, permeability, and hydrocarbon saturation. This provides a framework for volumetric calculations and other reserve estimation techniques.

Volumetric Calculations: This is a fundamental technique that calculates reserves based on the reservoir's size, porosity, hydrocarbon saturation, and recovery factor. It requires accurate determination of reservoir geometry and rock and fluid properties. Accuracy is limited by the uncertainties inherent in these parameters.

Chapter 2: Models Used in 1P Estimation

Various models are used in conjunction with the techniques described above. These models range from simple empirical relationships to complex numerical simulations:

Arps Decline Curve Model: A widely used empirical model for predicting production decline. It assumes either exponential or hyperbolic decline.

Material Balance Equation: A fundamental equation describing the relationship between reservoir pressure, volume, and fluid properties.

Black Oil Reservoir Simulator: A type of numerical reservoir simulator that models the flow of oil, gas, and water in a reservoir.

Compositional Reservoir Simulator: A more advanced type of simulator that accounts for the changes in fluid composition due to pressure and temperature variations.

The choice of model depends on the complexity of the reservoir and the available data. Simpler models might suffice for mature fields with well-defined production history, while more complex models are needed for undeveloped or complex reservoirs.

Chapter 3: Software for 1P Estimation

Several software packages facilitate the estimation of proven reserves. These packages often integrate various techniques and models:

Petrel (Schlumberger): A comprehensive reservoir modeling and simulation software suite.

Eclipse (Schlumberger): A widely used reservoir simulator.

CMG (Computer Modelling Group): Another popular reservoir simulation software package.

RMS (Roxar): A suite of software for reservoir characterization and modeling.

Specialized Decline Curve Analysis Software: Several dedicated software packages exist for performing decline curve analysis.

The specific software used depends on the project requirements and the available resources. Many companies have internal workflows and custom tools built around commercial software.

Chapter 4: Best Practices in 1P Estimation

Accurate 1P estimation requires adherence to best practices:

Data Quality Control: Rigorous quality control of all input data is essential. Inaccurate or incomplete data can lead to significant errors in reserve estimates.

Uncertainty Analysis: Quantifying the uncertainty associated with reserve estimates is crucial. Monte Carlo simulation is a common technique used for this purpose.

Peer Review: Independent review of reserve estimates by qualified professionals helps ensure accuracy and objectivity.

Transparency and Documentation: Detailed documentation of the methodology and assumptions used in reserve estimation is vital for transparency and accountability.

Compliance with Industry Standards: Reserve estimates should comply with relevant industry standards, such as those established by the Society of Petroleum Engineers (SPE) or the Canadian Oil and Gas Association (COGA).

Chapter 5: Case Studies of Proven Reserve (1P) Estimation

(This section would require specific examples. Instead of providing hypothetical examples, mentioning types of case studies would be more useful)

Case studies would illustrate the application of the techniques and models discussed. Examples could include:

Case Study 1: A case study focusing on a mature field with extensive production history, demonstrating the use of material balance calculations and decline curve analysis.

Case Study 2: A case study illustrating the application of reservoir simulation to an undeveloped field, highlighting the challenges and uncertainties involved in estimating reserves in such fields.

Case Study 3: A case study comparing different reserve estimation methods for a specific reservoir, discussing the strengths and limitations of each approach.

Case Study 4: A case study analyzing the impact of uncertainty on reserve estimates, demonstrating the importance of quantifying uncertainty in decision-making. The case study could demonstrate different levels of uncertainty in various parameters (e.g., porosity, permeability, recovery factor).

These case studies would provide valuable insights into the practical application of 1P estimation techniques and the challenges involved. Specific details would need to be added based on available data and examples from published literature.

- Behind Pipe Reserves احتياطيات خلف الأنابيب: استخر…

- Demonstrated Reserves فك رموز الاحتياطيات المؤكدة: …

- Developed Reserves (reservoir) الاحتياطيات المطورة: مصدر موث…

- Discovered (reserves) "الاحتياطيات المكتشفة" في الن…

- Non-Producing Reserves كشف الإمكانات: فهم الاحتياطيا…

- PDNP (reserves) احتياطيات PDNP: العملاقان الص…

- PD (reserves) فهم احتياطيات PD (المُطوّرة) …

- Possible Reserves (3P) أساسيات هندسة الخزانات: دليل …

- Probable Reserves الغوص في عالم الاحتياطيات الم…

- Probable Reserves (2P) كشف الإمكانات: احتياطيات 2P ف…

- Proved Developed Reserves كشف الإمكانات: احتياطيات مُثب…

- Proved Reserves فهم الاحتياطيات المؤكدة: أساس…

- Proved Undeveloped Reserves الاحتياطيات المثبتة غير المطو…

- PUD (reserves) احتياطيات PUD (الاحتياطيات): …

- Recoverable Reserves فتح المستقبل: رحلة عميقة في ا…

- Contracted Reserves الاحتياطيات المتعاقد عليها: ح…

- Dry Gas (reserves) الغاز الجاف: آلة الطاقة النحي…

- Entitlement (reserves/production) حق الانتفاع (الاحتياطيات/الإن…

- Managerial Reserves الاحتياطيات الإدارية: شبكة ال…

- Possible Reserves كشف الإمكانات: فهم "الاحتياطي…

- طلب تبرير المصروفات طلب مبرر الإنفاق: د… تخطيط وجدولة المشروع

- التكلفة الميزانية للعمل المجدول فهم تكلفة العمل الم… تقدير التكلفة والتحكم فيها

- حدود البطارية فهم حدود البطارية ف… المصطلحات الفنية العامة

- أداة الصمام السفلي أداة الصمام السفلي:… الحفر واستكمال الآبار

- جدول المحتويات TOC: فهم قمة الإسمن… المصطلحات الفنية العامة

Comments