Reservoir Engineering

Reserves, 3P

Reserves: A Guide to Understanding 3P in Oil & Gas

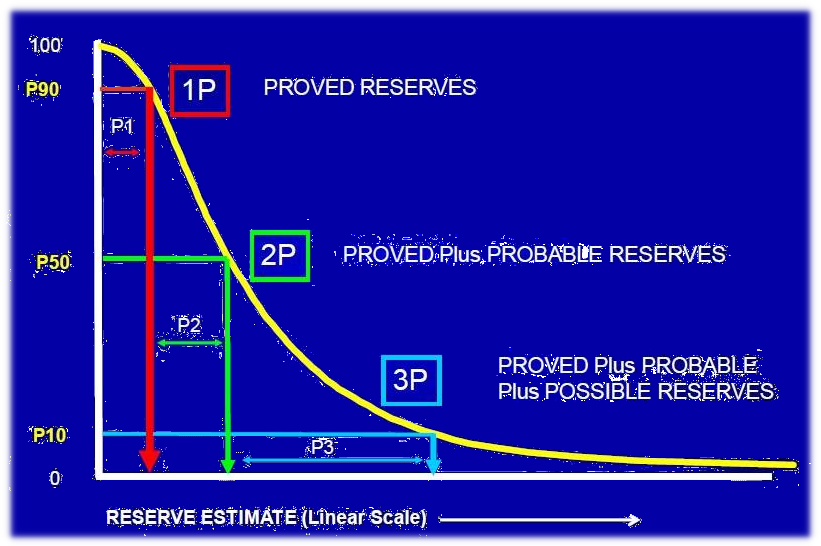

In the oil and gas industry, reserves refer to the estimated quantity of hydrocarbons (oil, natural gas, or natural gas liquids) that can be economically extracted from a known reservoir. These estimates are essential for companies to plan future production, investment, and development strategies.

However, quantifying reserves is a complex process involving geological, engineering, and economic considerations. This is where the 3P classification comes in, offering a standardized framework for categorizing reserves based on their level of certainty.

Here's a breakdown of the 3P categories:

1. Proven Reserves (1P):

- Definition: Reserves that are considered to be highly likely to be recovered with a high degree of certainty.

- Characteristics:

- Based on detailed geological and engineering data acquired through drilling, well testing, and production history.

- Supported by existing infrastructure and proven technology.

- Have a high probability of economic viability.

- Example: An oil well that has been producing for several years with known production rates and remaining reservoir volumes.

2. Probable Reserves (2P):

- Definition: Reserves that have a moderate level of certainty and are considered likely to be recovered.

- Characteristics:

- Based on less comprehensive data than proven reserves.

- May involve some uncertainties regarding reservoir properties or development plans.

- Have a good probability of being economically viable.

- Example: A new discovery well with promising initial production but requiring further appraisal and development plans before full recovery can be estimated.

3. Possible Reserves (3P):

- Definition: Reserves that have a low level of certainty and are considered potentially recoverable.

- Characteristics:

- Based on limited data and higher uncertainties regarding reservoir characteristics, development costs, or technology availability.

- May require further exploration or technological advancements for economic extraction.

- Example: A seismic anomaly that suggests the presence of hydrocarbons but requires further drilling to confirm and assess their volume and economic viability.

The Significance of the 3P Classification:

- Transparency and comparability: The 3P framework allows for standardized reporting of reserve estimates, enhancing transparency and comparability across different companies and projects.

- Investment decisions: Investors and lenders use the 3P classification to assess the risk and potential return of oil and gas projects, making it a crucial factor in investment decisions.

- Resource management: Understanding the level of certainty associated with different reserve categories helps companies plan for future production, allocate resources efficiently, and make informed decisions about exploration and development activities.

Important Note:

- The 3P classification is not static. Reserves can be reclassified as more information is gathered and uncertainties are reduced.

- While proven reserves are considered the most reliable, companies often consider probable and even possible reserves in their long-term planning, recognizing the potential for future growth and development.

By understanding the 3P classification, stakeholders gain a clearer picture of the risks and opportunities associated with oil and gas reserves, enabling informed decisions for investment, production, and resource management in this critical industry.

Test Your Knowledge

Quiz: Reserves and 3P Classification in Oil & Gas

Instructions: Choose the best answer for each question.

1. Which of the following best defines "reserves" in the oil and gas industry? a) The total amount of hydrocarbons discovered in a reservoir. b) The estimated quantity of hydrocarbons that can be economically extracted from a known reservoir. c) The amount of hydrocarbons currently being produced from a well. d) The amount of hydrocarbons that can be recovered using current technology.

Answer

b) The estimated quantity of hydrocarbons that can be economically extracted from a known reservoir.

2. What is the primary purpose of the 3P classification system? a) To categorize reserves based on their geological formation. b) To standardize reporting of reserve estimates and enhance transparency. c) To predict future oil and gas prices. d) To determine the environmental impact of oil and gas production.

Answer

b) To standardize reporting of reserve estimates and enhance transparency.

3. Which category of reserves has the highest level of certainty and is considered highly likely to be recovered? a) Proven Reserves (1P) b) Probable Reserves (2P) c) Possible Reserves (3P) d) All categories have equal certainty.

Answer

a) Proven Reserves (1P)

4. Which of the following is NOT a characteristic of Probable Reserves (2P)? a) Based on less comprehensive data than proven reserves. b) Supported by existing infrastructure and proven technology. c) May involve uncertainties regarding reservoir properties or development plans. d) Have a good probability of being economically viable.

Answer

b) Supported by existing infrastructure and proven technology.

5. What is the significance of the 3P classification for investors and lenders? a) It helps them understand the potential risks and returns of oil and gas projects. b) It allows them to accurately predict future oil and gas prices. c) It helps them determine the environmental impact of oil and gas production. d) It allows them to estimate the cost of developing new oil and gas fields.

Answer

a) It helps them understand the potential risks and returns of oil and gas projects.

Exercise: 3P Classification Application

Scenario:

An oil exploration company has discovered a new reservoir. Initial exploration data suggests a large volume of oil, but further drilling and analysis are needed to confirm the exact volume and assess the economic viability of extraction.

Task:

- Based on the information provided, which category of reserves would this discovery likely fall under (1P, 2P, or 3P)? Explain your reasoning.

- What additional information would be needed to potentially reclassify these reserves to a higher category?

Exercice Correction

1. The discovery would likely fall under **Possible Reserves (3P)**. This is because: * **Limited Data:** The initial exploration data suggests a large volume of oil, but further drilling and analysis are needed to confirm the exact volume. * **Higher Uncertainties:** The economic viability of extraction is yet to be assessed. * **Further Exploration:** More drilling and analysis are required to confirm the volume and assess the economic viability. 2. To reclassify these reserves to a higher category (2P or even 1P), the company would need to gather additional information, including: * **Detailed geological and engineering data:** Conducting further drilling and well testing to accurately estimate the reservoir size and characteristics. * **Economic analysis:** Evaluating the costs of extraction, processing, and transportation to assess the project's profitability. * **Development plan:** Developing a comprehensive plan for infrastructure development, production methods, and logistics. Once this information is gathered and analyzed, the company can make a more confident assessment of the reserves and potentially reclassify them to a higher category with greater certainty.

Books

- Petroleum Resources Management System (PRMS) - 2018: This comprehensive document by the Society of Petroleum Engineers (SPE) and the World Petroleum Council (WPC) provides a detailed explanation of the 3P classification system and its application.

- Reservoir Engineering Handbook: Edited by Tarek Ahmed, this handbook covers various aspects of reservoir engineering, including reserve estimation and 3P classification.

- Fundamentals of Petroleum Engineering: By Dr. John Lee, this textbook provides a strong foundation in petroleum engineering principles, including reserve evaluation methods.

Articles

- "The Importance of the 3P Classification in Oil and Gas Exploration and Production": Published in the Journal of Petroleum Technology, this article explores the significance of 3P classification for stakeholders in the industry.

- "A Review of the 3P Reserve Classification System and Its Applications": Published in the Journal of Energy Resources Technology, this paper analyzes the evolution and current applications of the 3P classification.

- "Understanding the 3P Classification: A Guide for Investors": Published in the Oil & Gas Investor magazine, this article explains the 3P system in a way that is accessible to non-technical audiences.

Online Resources

- Society of Petroleum Engineers (SPE): The SPE website provides access to various resources related to reserve estimation and 3P classification, including technical papers, training materials, and industry standards.

- World Petroleum Council (WPC): The WPC website offers information about the PRMS and its role in promoting transparency and best practices in the oil and gas industry.

- Oil & Gas Journal (OGJ): OGJ is a leading industry publication that frequently publishes articles and reports on reserve estimations, 3P classification, and related topics.

Search Tips

- Use specific keywords like "3P reserve classification," "oil and gas reserve estimation," or "PRMS" to refine your search.

- Combine keywords with the names of specific organizations like "SPE," "WPC," or "OGJ."

- Use quotation marks to search for exact phrases, such as "Proven, Probable, and Possible Reserves."

- Filter your results by date or source type to narrow down the most relevant information.

Techniques

Reserves: A Guide to Understanding 3P in Oil & Gas

This guide expands on the initial introduction to Reserves and the 3P classification system in the oil and gas industry. The following chapters delve deeper into specific aspects of this crucial topic.

Chapter 1: Techniques for Estimating Reserves

Estimating hydrocarbon reserves is a complex process relying on several integrated techniques. These techniques aim to quantify the volume of hydrocarbons in place, and the amount that can be economically extracted. Key techniques include:

Geological Characterization: This involves detailed analysis of subsurface data, including seismic surveys, well logs, core analysis, and pressure tests. The goal is to construct a three-dimensional geological model of the reservoir, defining its geometry, porosity, permeability, and fluid saturation. Advanced techniques like 3D seismic imaging and reservoir simulation play a vital role.

Reservoir Engineering: Reservoir engineers use the geological model to predict fluid flow behavior, estimate recovery factors, and model production performance under different scenarios. This involves sophisticated simulations, considering factors such as pressure depletion, water influx, and gas cap expansion. Decline curve analysis and material balance calculations help predict future production.

Production Data Analysis: Historical production data provides crucial input for reservoir models. Analyzing production rates, pressure decline, and water cut helps calibrate and validate the reservoir models, providing insights into reservoir performance and remaining reserves.

Economic Evaluation: The economic viability of extraction is a critical factor in reserve estimation. This requires estimating capital and operating costs, hydrocarbon prices, and tax implications to determine the net present value (NPV) of the project. Sensitivity analyses are performed to assess the impact of various uncertainties on the economic viability.

Uncertainty Analysis: Inherent uncertainties exist in every stage of reserve estimation. Techniques like Monte Carlo simulation are used to quantify the uncertainty associated with each parameter and propagate this uncertainty through the entire estimation process. This generates a probabilistic distribution of reserves, rather than a single point estimate, reflecting the level of confidence.

Chapter 2: Models Used in Reserve Estimation

Various models are employed to estimate hydrocarbon reserves, each with specific strengths and limitations. The choice of model depends on the data availability, reservoir complexity, and the desired level of accuracy:

Deterministic Models: These models use a single set of input parameters to generate a single estimate of reserves. While simpler to use, they fail to capture the inherent uncertainty. They are often used in early stages of assessment when data is limited.

Probabilistic Models: These models incorporate uncertainty by using a range of input parameters. Monte Carlo simulation is the most common probabilistic technique. It generates numerous realizations of the reservoir model and calculates a probability distribution of reserves, providing a more comprehensive and realistic assessment.

Decline Curve Analysis: This technique models the decline in production rate over time. It's a relatively simple yet effective method for estimating reserves, particularly for mature fields with established production history.

Material Balance Calculations: These calculations use the principles of fluid mechanics and thermodynamics to estimate the original hydrocarbon volume in place and the remaining reserves. They are most accurate for relatively simple reservoirs with limited fluid flow complexity.

Reservoir Simulation: This sophisticated technique utilizes numerical methods to model fluid flow and production behavior in complex reservoirs. It can incorporate various reservoir characteristics, operational strategies, and uncertainties, providing detailed forecasts of reservoir performance and reserve estimations.

Chapter 3: Software for Reserve Estimation

Specialized software packages are essential for accurate and efficient reserve estimation. These software packages incorporate the techniques and models described in previous chapters, streamlining the process and enhancing accuracy:

Petrel (Schlumberger): A widely used integrated reservoir modeling and simulation platform. It provides tools for geological modeling, reservoir simulation, production forecasting, and uncertainty analysis.

RMS (Roxar): Another comprehensive reservoir modeling and simulation software package with advanced capabilities for geological modeling, fluid flow simulation, and uncertainty quantification.

Eclipse (Schlumberger): A leading reservoir simulator known for its robustness and ability to handle complex reservoir models.

CMG (Computer Modelling Group): Offers a suite of reservoir simulation software, including both black-oil and compositional simulators for detailed reservoir modeling and forecasting.

Specialized Plugins and Add-ons: Many software packages offer specialized plugins and add-ons for specific tasks such as decline curve analysis, material balance calculations, and uncertainty analysis.

Chapter 4: Best Practices in Reserve Estimation

Adherence to best practices is crucial for ensuring the accuracy, reliability, and transparency of reserve estimates. Key best practices include:

Data Quality Control: Rigorous quality control procedures should be implemented throughout the data acquisition and processing stages to ensure the accuracy and reliability of input data.

Independent Audit: Independent audits provide an objective assessment of the reserve estimates, enhancing credibility and transparency.

Industry Standards Compliance: Reserve estimations should follow established industry standards, such as those defined by the Society of Petroleum Engineers (SPE) and the Securities and Exchange Commission (SEC).

Documentation: Detailed documentation of the entire estimation process, including data sources, methods, assumptions, and uncertainties, is essential for ensuring transparency and reproducibility.

Regular Review and Updates: Reserve estimates should be regularly reviewed and updated as new data become available and uncertainties are reduced.

Chapter 5: Case Studies in Reserve Estimation

Several case studies can illustrate the application of different techniques and models in various reservoir settings:

Case Study 1: Mature Field Redevelopment: This would detail the use of decline curve analysis and material balance calculations to estimate reserves in a mature field undergoing redevelopment. It would highlight the challenges of using historical data and incorporating uncertainty.

Case Study 2: New Field Discovery: This would demonstrate the use of advanced techniques like 3D seismic imaging and reservoir simulation to estimate reserves in a newly discovered field, emphasizing the uncertainties associated with exploration and early development phases.

Case Study 3: Heavy Oil Reservoir: This could show the use of specialized techniques to estimate reserves in a heavy oil reservoir, considering the unique challenges associated with viscous oil production.

Case Study 4: Unconventional Reservoir: This would present the application of techniques for unconventional resources, like shale gas or tight oil, highlighting the difference in reserve estimation compared to conventional reservoirs.

These case studies would not only show the application of techniques but also highlight the importance of careful consideration of geological settings, uncertainties, and economic factors in reserve estimations. They would underscore the fact that each project is unique, and a tailored approach is required.

- Possible Reserves (3P) The 3P's of Reservoir Enginee…

- Reserves, 1P Understanding Reserves: Unloc…

- Reserves, 2P Unveiling the Oil & Gas Myste…

- Reserves, Behind Pipe Behind-the-Pipe: Unlocking Hi…

- Reserves, Developed Understanding "Reserves, Deve…

- Reserves, Entitlement Understanding Reserves and En…

- Reserves, Extension Reserves Extension: Expanding…

- Reserves, Non Producing Understanding "Reserves, Non-…

- Reserves, Possible Unlocking Potential: Understa…

- Reserves, Probable Understanding Probable Reserv…

- Reserves, Producing Unlocking the Potential: Unde…

- Reserves, Proved Understanding Proved Reserves…

- Reserves, Proved Developed Demystifying Oil & Gas Reserv…

- Reserves, Unproved Unlocking the Potential: Unde…

- Reserves, Recoverable Understanding Reserves and Re…

- Reserves, Undeveloped Untapped Potential: Understan…

- Application for Expenditure Justification Navigating the Appl… Project Planning & Scheduling

- Budgeted Cost of Work Scheduled ("BCWS") Understanding Budge… Cost Estimation & Control

- Battery limit Understanding Batte… General Technical Terms

- DV Tool (cementing) DV Tool: A Crucial … Drilling & Well Completion

- TOC TOC: Understanding … General Technical Terms

Comments