Reservoir Engineering

Reserves, 1P

Understanding Reserves: Unlocking the Potential of 1P in the Oil and Gas Industry

In the complex world of oil and gas, understanding the term "reserves" is crucial for investors, analysts, and industry professionals alike. This article delves into the concept of reserves, focusing on the category known as "1P" (Proven reserves) and its significance in evaluating the financial health and potential of oil and gas companies.

What are Reserves?

Reserves represent the estimated quantity of oil and gas that can be economically extracted from a specific reservoir under current technological and economic conditions. These estimates are not absolute figures but rather probabilities based on detailed geological and engineering assessments.

Types of Reserves: A Hierarchy of Certainty

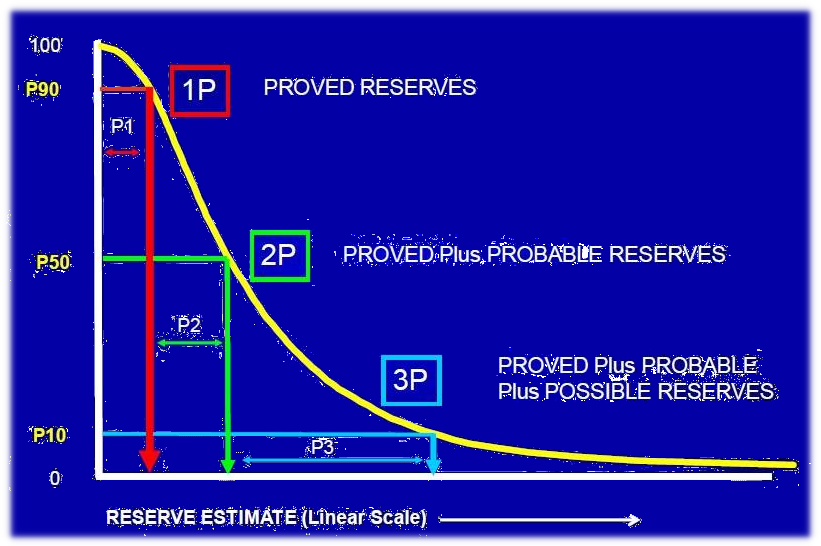

The oil and gas industry categorizes reserves based on the level of certainty associated with their estimation:

- 1P (Proven): This category represents the most certain reserves, with a high probability of recovery. Proven reserves are based on detailed geological and engineering studies, including well testing, core analysis, and production history. They have a high likelihood of being extracted under current economic conditions.

- 2P (Probable): Probable reserves are less certain than proven reserves. While they are still considered to be recoverable, there may be some uncertainties related to their geological characteristics or economic feasibility. They may require further exploration or development before production can begin.

- 3P (Possible): Possible reserves are the least certain category. They are based on preliminary data and may not be considered recoverable under current conditions. Further exploration and testing are necessary to determine their true potential.

The Importance of 1P Reserves

1P reserves are particularly important for investors and analysts as they offer a reliable measure of a company's current production potential and future earnings. They form the basis for financial modeling and valuation, providing insights into a company's ability to generate cash flow and return on investment.

- Financial Reporting: Publicly traded oil and gas companies are required to disclose their 1P reserves in their financial statements, providing transparency for investors.

- Debt Financing: Banks and other lenders often use 1P reserves as a primary factor in evaluating loan applications and determining creditworthiness.

- Mergers and Acquisitions: 1P reserves are a critical factor in determining the value of an oil and gas company during mergers and acquisitions.

Challenges and Considerations

Despite their importance, 1P reserves are not without limitations:

- Dynamic nature: Reserves can fluctuate based on changes in technology, oil prices, and regulatory frameworks.

- Subjectivity: The estimation of reserves involves some degree of subjectivity, and different companies may use different methods.

- Depletion: 1P reserves will naturally deplete over time as oil and gas are extracted.

Conclusion

Understanding the concept of reserves, particularly 1P reserves, is essential for navigating the world of oil and gas investments. This information empowers investors, analysts, and industry professionals to assess the financial health and future prospects of oil and gas companies. By carefully evaluating 1P reserves alongside other relevant factors, stakeholders can make informed decisions based on a solid understanding of the industry's complexities.

Test Your Knowledge

Quiz: Understanding Reserves in Oil & Gas

Instructions: Choose the best answer for each question.

1. What does "1P" stand for in oil and gas reserves classification? a) Probable b) Proven c) Possible d) Potential

Answer

b) Proven

2. Which of the following statements is TRUE about 1P reserves? a) They are based on preliminary data and may not be recoverable. b) They are less certain than probable reserves. c) They have a high probability of being extracted under current economic conditions. d) They are primarily used for exploration and development planning.

Answer

c) They have a high probability of being extracted under current economic conditions.

3. Why are 1P reserves particularly important for investors and analysts? a) They offer a reliable measure of a company's potential future production. b) They are the only type of reserve used for financial reporting. c) They are the primary factor in determining the value of a company during mergers. d) All of the above.

Answer

d) All of the above.

4. What is a significant challenge associated with 1P reserves? a) They are static and never change over time. b) They are not subject to any regulations or reporting requirements. c) They can fluctuate due to changes in technology and oil prices. d) They are not used for making loan decisions by banks.

Answer

c) They can fluctuate due to changes in technology and oil prices.

5. Which of the following IS NOT a factor that influences the estimation of 1P reserves? a) Geological studies b) Well testing data c) Market sentiment d) Production history

Answer

c) Market sentiment

Exercise: Evaluating a Company's Reserves

Scenario: Imagine you are an analyst reviewing the financial reports of "OilCo," a publicly traded oil and gas company. OilCo reports having 1P reserves of 100 million barrels of oil equivalent (BOE) at the end of 2023.

Task:

- Research: Find a real-world oil and gas company and compare its 1P reserves to OilCo's reported reserves.

- Analysis: Analyze the potential implications of OilCo's 1P reserves on the company's financial health and future growth prospects. Consider factors like:

- Current production levels

- Historical production trends

- Industry benchmarks for reserve life

- Oil price volatility

Exercise Correction:

Exercice Correction

This exercise is designed to encourage you to research and analyze real-world data. There is no single "correct" answer. Here's an example of how you might approach it:

**1. Research:**

You might choose a company like ExxonMobil, which publicly reports its 1P reserves in its annual reports. Let's say ExxonMobil reports 1P reserves of 25 billion BOE. This significantly exceeds OilCo's 100 million BOE.

**2. Analysis:**

Comparing OilCo's 100 million BOE to ExxonMobil's 25 billion BOE highlights a significant size difference. This suggests:

- OilCo is likely a much smaller company with limited production capacity compared to ExxonMobil.

- OilCo's 1P reserves may be sufficient for its current production but could be insufficient to sustain long-term growth if they don't discover new reserves.

- OilCo's reliance on a smaller reserve base might make it more vulnerable to oil price fluctuations.

You can further analyze the company's financial reports, production history, and industry trends to form a more complete assessment of OilCo's future prospects. Remember, this is just a basic example. Thorough analysis would involve examining various financial metrics, comparing OilCo's performance to industry benchmarks, and assessing the potential impact of geopolitical and economic factors.

Books

- Petroleum Engineering Handbook: Edited by W.D. McCain Jr., this comprehensive handbook covers various aspects of petroleum engineering, including reserve estimation techniques.

- The Economics of Petroleum: A Primer: By Robert E. Turner, this book provides an in-depth analysis of the economic principles underpinning the oil and gas industry, including reserve evaluation.

- Oil and Gas Reserves: A Guide to Estimating and Reporting: By Richard A. Baker, this book offers practical guidance on estimating and reporting reserves, focusing on industry standards and best practices.

Articles

- "Reserves Reporting Standards: A Guide to Understanding the SEC’s New Rules for Oil and Gas Companies" by the Society of Petroleum Engineers (SPE) provides insights into the new regulations and reporting standards for reserve estimates.

- "The Evolution of Reserve Definitions: A Historical Perspective" by J.A. Tiratsoo, published in the journal Petroleum Geoscience, explores the historical development of reserve categories and their impact on the industry.

- "The Importance of Reserves in Oil and Gas Acquisitions" by David M. Cook, published in the Journal of Petroleum Technology, highlights the role of reserves in mergers and acquisitions.

Online Resources

- Society of Petroleum Engineers (SPE): https://www.spe.org/ - This organization offers a wealth of resources on petroleum engineering, including publications, conferences, and educational materials related to reserve estimation.

- U.S. Securities and Exchange Commission (SEC): https://www.sec.gov/ - The SEC website provides access to regulations and guidance related to reserve reporting by publicly traded oil and gas companies.

- Canadian Securities Administrators (CSA): https://www.csa-csa.ca/ - The CSA website contains regulatory information on reserve reporting for Canadian oil and gas companies.

- World Energy Council: https://www.worldenergy.org/ - This organization publishes reports and research on global energy trends, including the oil and gas industry, and often covers reserve estimation and production issues.

Search Tips

- "Oil and Gas Reserves" - This general search will yield various resources, including articles, reports, and websites on the topic.

- "1P Reserves Definition" - This specific search will provide definitions and explanations of proven reserves.

- "Reserve Estimation Methods" - This search will return resources on different techniques used to estimate oil and gas reserves.

- "Reserve Reporting Standards" - This search will lead you to documents and information on the regulations and standards governing reserve reporting.

- "Oil and Gas Company Reserve Reports" - This search can help you find publicly available reports on reserves by specific oil and gas companies.

Techniques

Understanding Reserves: 1P in the Oil and Gas Industry - A Deeper Dive

This expands on the provided text, breaking it down into chapters.

Chapter 1: Techniques for Estimating 1P Reserves

The estimation of 1P (Proven) reserves relies on a robust combination of geological and engineering techniques. Accuracy is paramount, as these figures are crucial for financial reporting and decision-making. Key techniques include:

Geological Modeling: This involves creating a 3D representation of the reservoir, incorporating data from seismic surveys, well logs (e.g., gamma ray, resistivity, density), core analysis (porosity, permeability), and pressure tests. The model helps define the reservoir's geometry, rock properties, and fluid distribution. Sophisticated software allows for complex interpretations and uncertainty quantification.

Reservoir Simulation: Numerical reservoir simulation models use the geological model as input to predict the behavior of the reservoir under different production scenarios. These models account for fluid flow, pressure changes, and production rates, helping estimate the recoverable volume of hydrocarbons. History matching, where the model is calibrated to match past production data, is crucial for accuracy.

Material Balance Calculations: These calculations utilize basic principles of fluid mechanics and thermodynamics to estimate reservoir parameters such as initial oil-in-place and recovery factors. They provide an independent check on the results from reservoir simulation.

Decline Curve Analysis: Analyzing historical production data using decline curves allows for the prediction of future production rates and ultimately, the estimation of ultimate recovery. Various decline curve models exist, each suited to different reservoir types and production mechanisms.

Analogue Studies: Comparing the reservoir under study with similar, well-characterized reservoirs can provide valuable insights and help constrain the uncertainty in reserve estimates.

The accuracy of 1P reserve estimations depends heavily on the quality and quantity of data available, as well as the expertise of the geoscientists and engineers involved.

Chapter 2: Models Used for 1P Reserve Estimation

Several models are employed in estimating 1P reserves, each with its strengths and weaknesses:

Volumetric Method: This is a simple yet effective approach, particularly for reservoirs with relatively homogeneous properties. It estimates reserves by multiplying the reservoir volume by the hydrocarbon saturation and recovery factor. This method is often used as a first-order estimate.

Material Balance Method: This method relies on tracking the changes in reservoir pressure and fluid volume over time to estimate the initial hydrocarbon in place and ultimate recovery. It's particularly useful for reservoirs with limited production history.

Decline Curve Analysis Methods: Various decline curve models (e.g., exponential, hyperbolic, harmonic) are used to extrapolate past production trends to estimate future production and ultimate recovery. The choice of model depends on the reservoir's production characteristics.

Reservoir Simulation Models: These are complex, computationally intensive models that simulate the fluid flow and pressure behavior within the reservoir. They provide the most detailed and accurate reserve estimations, accounting for factors such as reservoir heterogeneity, fluid properties, and production strategies. These models are commonly used for larger, more complex fields.

The selection of the appropriate model depends on the data availability, reservoir complexity, and the level of accuracy required. Often, a combination of methods is used to ensure robust reserve estimates.

Chapter 3: Software for 1P Reserve Estimation

Specialized software plays a critical role in 1P reserve estimation, facilitating complex calculations, data visualization, and uncertainty analysis. Some widely used software packages include:

Petrel (Schlumberger): A comprehensive suite of tools for geological modeling, reservoir simulation, and data management.

Eclipse (Schlumberger): A powerful reservoir simulator used for predicting reservoir performance under various production scenarios.

CMG (Computer Modelling Group): Another leading reservoir simulation software package with a wide range of capabilities.

Roxar (now part of Emerson Automation Solutions): Software for reservoir characterization, modeling, and simulation.

These packages provide integrated workflows that combine geological modeling, reservoir simulation, and economic analysis to generate comprehensive reserve estimates. They also facilitate uncertainty analysis, allowing for a quantification of the risk associated with reserve estimations.

Chapter 4: Best Practices for 1P Reserve Estimation

Ensuring the reliability and credibility of 1P reserve estimations requires adherence to best practices:

Data Quality Control: Maintaining high-quality data is paramount. This includes rigorous data acquisition, validation, and auditing procedures.

Independent Verification: Having an independent third-party review of reserve estimates enhances credibility and reduces bias.

Uncertainty Analysis: Quantifying the uncertainty associated with reserve estimations is essential for transparency and decision-making. Probabilistic methods are commonly used to assess the range of possible outcomes.

Compliance with Industry Standards: Adhering to industry standards and guidelines (e.g., SPEPR) ensures consistency and comparability of reserve estimations.

Regular Updates: Reserve estimates should be regularly updated to reflect changes in technology, production data, and economic conditions.

Following these best practices ensures that 1P reserve estimations are reliable, transparent, and contribute to sound decision-making.

Chapter 5: Case Studies of 1P Reserve Estimation

(This section would require specific examples of 1P reserve estimation projects. Due to the confidential nature of such data, providing real-world case studies requires access to public data from completed projects. Here's a framework for how such a case study might be structured):

Case Study Example (Hypothetical): The XYZ Oil Field

Description: A brief overview of the XYZ oil field, including its geological setting, reservoir characteristics, and production history.

Data Acquisition and Processing: A summary of the data used in the reserve estimation process (seismic data, well logs, core analysis, production data).

Methodology: A detailed description of the techniques and models used for reserve estimation (e.g., volumetric method, reservoir simulation).

Results: Presentation of the 1P reserve estimates, including uncertainty analysis.

Lessons Learned: Discussion of any challenges encountered during the estimation process and the insights gained.

Multiple case studies could be presented, showcasing different reservoir types, estimation methods, and challenges. The inclusion of publicly available data from completed projects would make this section more impactful.

- Proven Reserves (1P) Unlocking the Reservoir: Unde…

- Reserves, 2P Unveiling the Oil & Gas Myste…

- Reserves, 3P Reserves: A Guide to Understa…

- Reserves, Behind Pipe Behind-the-Pipe: Unlocking Hi…

- Reserves, Developed Understanding "Reserves, Deve…

- Reserves, Entitlement Understanding Reserves and En…

- Reserves, Extension Reserves Extension: Expanding…

- Reserves, Non Producing Understanding "Reserves, Non-…

- Reserves, Possible Unlocking Potential: Understa…

- Reserves, Probable Understanding Probable Reserv…

- Reserves, Producing Unlocking the Potential: Unde…

- Reserves, Proved Understanding Proved Reserves…

- Reserves, Proved Developed Demystifying Oil & Gas Reserv…

- Reserves, Unproved Unlocking the Potential: Unde…

- Reserves, Recoverable Understanding Reserves and Re…

- Reserves, Undeveloped Untapped Potential: Understan…

- Application for Expenditure Justification Navigating the Appl… Project Planning & Scheduling

- Budgeted Cost of Work Scheduled ("BCWS") Understanding Budge… Cost Estimation & Control

- Battery limit Understanding Batte… General Technical Terms

- DV Tool (cementing) DV Tool: A Crucial … Drilling & Well Completion

- TOC TOC: Understanding … General Technical Terms

Comments