Reservoir Engineering

Reserves, 2P

Unveiling the Oil & Gas Mystery: Understanding 2P Reserves

In the world of oil and gas, understanding reserve classifications is crucial for investors, companies, and governments alike. One of the most common terms you'll encounter is 2P reserves, often referred to as proved plus probable reserves. This article delves into the meaning and significance of 2P reserves, helping you navigate the complexities of oil and gas estimations.

The Spectrum of Reserves:

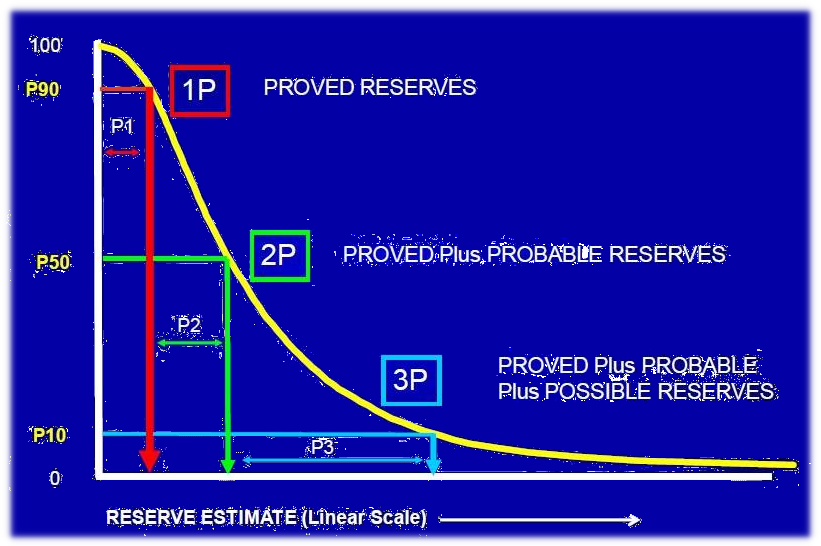

Oil and gas reserves are classified based on the level of certainty associated with their potential recovery. This classification system helps stakeholders gauge the reliability of estimated resource volumes.

- Proved Reserves (1P): These are the most certain reserves, with a high degree of confidence in their existence and recoverability. They are based on well testing, geological data, and established production history.

- Probable Reserves (2P): This category includes reserves that are considered likely to be recovered but have a slightly lower degree of certainty than proved reserves. These estimates rely on similar geological evidence as proved reserves, but may require further exploration or development to confirm their full potential.

- Possible Reserves (3P): Possible reserves represent resources that are considered potentially recoverable but with a significantly lower certainty than proved or probable reserves. Their recovery is contingent on favorable geological conditions and successful exploration efforts.

The Power of 2P:

2P reserves combine both proved and probable reserves, offering a more comprehensive view of a company's potential resource base. This is often preferred by investors and analysts as it considers both the most certain and likely recoverable resources.

- Investor Confidence: 2P reserves provide a realistic estimate of the resources a company can potentially extract, boosting investor confidence. It allows them to assess the company's future potential and financial viability.

- Strategic Planning: 2P reserves are essential for companies in their strategic planning and resource allocation decisions. They can guide exploration and development efforts, ensuring that resources are directed towards areas with the highest potential for recovery.

- Government Regulations: 2P reserves are often used by governments in setting royalties, taxes, and other regulations related to oil and gas extraction.

Key Considerations:

- Reserve Estimation Methods: Different companies employ various methods to estimate reserves, leading to potential variations in their 2P numbers. It is crucial to analyze the methodologies used and compare them across different companies.

- Risk Factors: While 2P reserves are considered more reliable than possible reserves, they are not guaranteed. External factors, such as technological advancements, fluctuating oil prices, and environmental regulations, can significantly impact their actual recovery.

- Continuous Evaluation: Reserve estimates are dynamic and subject to change based on new geological discoveries, technological advancements, and economic factors. Companies are expected to regularly update their reserve estimates to reflect the latest available information.

Conclusion:

Understanding 2P reserves is crucial for anyone navigating the oil and gas sector. It provides a clear picture of a company's potential resource base, aiding investors in making informed decisions and helping companies strategize for future development. By considering the nuances of reserve classification and constantly seeking updated information, you can confidently navigate the complexities of the oil and gas landscape.

Test Your Knowledge

Quiz: Unveiling the Oil & Gas Mystery: Understanding 2P Reserves

Instructions: Choose the best answer for each question.

1. What does "2P" stand for in oil and gas reserves? a) Proven and Possible Reserves b) Probable and Possible Reserves c) Proved and Probable Reserves d) Potential and Probable Reserves

Answer

c) Proved and Probable Reserves

2. Which of the following is NOT a benefit of using 2P reserves for investors? a) Provides a realistic estimate of a company's potential resource base. b) Allows investors to assess a company's future potential and financial viability. c) Guarantees the actual recovery of the estimated resources. d) Helps investors make informed decisions.

Answer

c) Guarantees the actual recovery of the estimated resources.

3. Which category of reserves has the highest degree of certainty? a) Proved Reserves (1P) b) Probable Reserves (2P) c) Possible Reserves (3P) d) All categories have equal certainty.

Answer

a) Proved Reserves (1P)

4. What is a key consideration when analyzing 2P reserves? a) The company's marketing strategy. b) The company's financial history. c) The reserve estimation methods used. d) The company's social media presence.

Answer

c) The reserve estimation methods used.

5. Why are 2P reserves considered dynamic and subject to change? a) Fluctuating oil prices. b) Changes in government regulations. c) New geological discoveries and technological advancements. d) All of the above.

Answer

d) All of the above.

Exercise: Applying 2P Reserves

Scenario:

You are an investor considering investing in an oil and gas company. Two companies, Alpha Oil and Beta Gas, are presenting their reserve estimates:

- Alpha Oil: 1P Reserves: 100 million barrels, 2P Reserves: 150 million barrels

- Beta Gas: 1P Reserves: 80 million barrels, 2P Reserves: 120 million barrels

Task:

- Based on the provided information, which company appears to have a larger potential resource base?

- Explain your reasoning, considering the significance of 2P reserves.

Exercice Correction

1. Alpha Oil appears to have a larger potential resource base. 2. Although Beta Gas has a higher percentage increase from 1P to 2P reserves (50% compared to Alpha Oil's 50%), Alpha Oil has a larger overall 2P reserve estimate (150 million barrels vs. 120 million barrels). This indicates that Alpha Oil has a greater potential to recover more oil, making it a potentially more attractive investment.

Books

- Petroleum Resources Management System (PRMS): This book published by the Society of Petroleum Engineers (SPE) outlines the comprehensive methodology for classifying and evaluating oil and gas reserves, including the 2P category. https://www.spe.org/en/bookstore/products/petroleum-resources-management-system-prms

- Oil and Gas Reserves: A Comprehensive Guide to Resource Evaluation and Management: This book by S. M. Ali provides a detailed explanation of different reserve classification systems, including 2P, and the factors that influence their estimation. https://www.amazon.com/Oil-Gas-Reserves-Comprehensive-Management/dp/1466594062

Articles

- "Understanding Oil and Gas Reserve Classifications: 1P, 2P, and 3P" by Investopedia: Provides a concise overview of the different reserve classifications, focusing on the significance of 2P reserves for investors. https://www.investopedia.com/terms/o/oil-and-gas-reserves.asp

- "What are 2P reserves?" by Energy Voice: Explains the concept of 2P reserves in a clear and accessible manner, highlighting their importance in assessing company performance and investment potential. https://www.energyvoice.com/oilandgas/162605/what-are-2p-reserves/

Online Resources

- Society of Petroleum Engineers (SPE): SPE is a leading professional organization in the oil and gas industry. Their website offers a wealth of resources, including technical papers, webinars, and guidelines related to reserve estimation and classification. https://www.spe.org/

- World Petroleum Council: The World Petroleum Council is another important organization in the industry, providing information on global oil and gas trends, including reserve data and regulatory frameworks. https://www.worldpetroleum.org/

Search Tips

- Use specific keywords: Instead of just "2P reserves," try phrases like "2P reserves meaning," "2P reserves vs 1P," or "how to estimate 2P reserves."

- Include relevant industry terms: Combine "2P reserves" with terms like "oil & gas," "petroleum," or "exploration and production" to narrow down your search.

- Use advanced search operators: Utilize operators like quotation marks (" ") to find exact phrases, or a minus sign (-) to exclude irrelevant results.

Techniques

Chapter 1: Techniques for Estimating 2P Reserves

This chapter explores the various methods employed by oil and gas companies to estimate 2P reserves, highlighting their strengths and limitations.

1.1 Volumetric Methods

- Description: These methods rely on geological data, including reservoir size, porosity, and hydrocarbon saturation, to calculate the total volume of hydrocarbons in place. This volume is then adjusted based on recovery factors, which account for the percentage of oil and gas that can be extracted economically.

- Strengths: Simple and widely used, particularly in early exploration stages when limited production data is available.

- Limitations: Relies heavily on geological assumptions and can be inaccurate if the reservoir's characteristics are not well understood.

1.2 Analogue Methods

- Description: These methods use data from similar reservoirs with known production histories to estimate the potential of the target reservoir. This approach leverages past experience and geological correlations.

- Strengths: Useful when limited well data is available, particularly in early development phases.

- Limitations: Relies on the accuracy of the analogue reservoir data and the assumption that the target reservoir behaves similarly.

1.3 Production Decline Curve Analysis

- Description: This method uses past production data to project future production rates. It assumes that production will decline at a predictable rate, allowing for estimation of remaining recoverable reserves.

- Strengths: Based on real production data, offering a more accurate picture of potential reserves than volumetric or analogue methods.

- Limitations: Relies on the assumption that production will follow a predictable pattern, which may not always hold true.

1.4 Material Balance Methods

- Description: These methods analyze the production history and reservoir pressure data to estimate the remaining hydrocarbons. This approach considers the physical properties of the reservoir and the movement of fluids.

- Strengths: Provides a more sophisticated and accurate estimate of reserves by accounting for reservoir fluid dynamics.

- Limitations: Requires detailed data and can be complex to implement, often applied later in the development stage.

1.5 Reservoir Simulation

- Description: This advanced technique uses computer models to simulate the behavior of the reservoir over time. It integrates geological, engineering, and production data to create a detailed representation of the reservoir.

- Strengths: Provides the most comprehensive and accurate estimate of reserves, taking into account various factors impacting production.

- Limitations: Requires significant data collection and analysis, making it costly and time-consuming.

1.6 Choosing the Right Technique

The choice of estimation technique depends on the availability of data, the stage of development, and the specific characteristics of the reservoir. Combining different methods often provides a more robust and reliable estimate of 2P reserves.

Chapter 2: Models for 2P Reserves Estimation

This chapter explores the various models used by oil and gas companies to calculate 2P reserves.

2.1 Deterministic Models

- Description: These models use a single set of assumptions to estimate reserves, leading to a single point estimate.

- Strengths: Relatively simple and straightforward to implement, often used for initial estimates.

- Limitations: Do not account for uncertainties in the input data and may not reflect the true range of possible outcomes.

2.2 Probabilistic Models

- Description: These models incorporate uncertainties in the input data by using probability distributions for key parameters. They provide a range of possible reserve estimates, along with their likelihoods.

- Strengths: Provide a more comprehensive and realistic picture of the uncertainty surrounding reserve estimates.

- Limitations: More complex to implement and require significant data analysis.

2.3 Monte Carlo Simulation

- Description: A specific type of probabilistic model that uses random sampling to generate multiple possible outcomes for reserves. This method provides a distribution of possible values, allowing for the calculation of key statistics like mean, median, and percentiles.

- Strengths: Most commonly used for estimating reserves as it provides a robust and comprehensive assessment of uncertainty.

- Limitations: Requires significant computing power and expertise to implement effectively.

2.4 Choosing the Right Model

The choice of model depends on the level of uncertainty in the input data, the desired level of detail, and the company's resources and expertise. Simple deterministic models may suffice for initial estimates, while probabilistic models are preferred when greater accuracy and uncertainty assessment are needed.

Chapter 3: Software for 2P Reserves Estimation

This chapter provides an overview of the software tools available for estimating 2P reserves, highlighting their features and functionalities.

3.1 Petrel

- Description: A comprehensive software package for reservoir characterization and modeling, offering advanced features for 2P reserves estimation.

- Features: Volumetric and analogue methods, production decline curve analysis, reservoir simulation.

- Strengths: Industry-standard software with powerful capabilities for complex reservoir modeling.

- Limitations: Expensive and requires significant technical expertise to use effectively.

3.2 Eclipse

- Description: A powerful reservoir simulator for simulating the flow of oil and gas in complex reservoirs. It enables companies to optimize production and estimate reserves.

- Features: Reservoir simulation, history matching, production forecasting.

- Strengths: Highly accurate and reliable, used by many major oil and gas companies.

- Limitations: Complex and computationally demanding, requiring experienced engineers to operate.

3.3 EasyRes

- Description: A user-friendly software package specifically designed for reserve estimation. It offers various methods, including volumetric, analogue, and decline curve analysis.

- Features: Simple interface, easy to learn and use, suitable for small and medium-sized companies.

- Strengths: Cost-effective and accessible, providing a good starting point for reserve estimation.

- Limitations: Limited in its capabilities compared to advanced software packages.

3.4 Other Tools

Numerous other software tools are available for 2P reserves estimation, including:

- Geologic Modeling Software: For building geological models of reservoirs.

- Production Data Analysis Software: For analyzing production data and projecting future production.

- Statistical Software: For performing probabilistic analyses and Monte Carlo simulations.

Chapter 4: Best Practices for Estimating 2P Reserves

This chapter outlines best practices for estimating 2P reserves, ensuring accuracy, reliability, and transparency.

4.1 Data Quality and Integrity

- Focus on: Ensuring the accuracy, completeness, and reliability of all data used for reserve estimation.

- Actions: Conduct thorough data audits, validate sources, and implement quality control measures.

4.2 Methodology Selection and Application

- Focus on: Choosing appropriate estimation techniques and models based on the specific characteristics of the reservoir and the stage of development.

- Actions: Clearly document the methodology used, including any assumptions made.

4.3 Uncertainty Analysis

- Focus on: Quantifying the uncertainty associated with reserve estimates, taking into account variations in input data, geological assumptions, and future events.

- Actions: Perform probabilistic analyses, sensitivity analyses, and Monte Carlo simulations.

4.4 Independent Verification

- Focus on: Ensuring the accuracy and reliability of reserve estimates by obtaining independent verification from qualified third parties.

- Actions: Engage independent reserve auditors, consultants, or experts to review and validate estimates.

4.5 Transparency and Disclosure

- Focus on: Communicating reserve estimates clearly and transparently to stakeholders, including investors, regulators, and the public.

- Actions: Prepare comprehensive reserve reports, disclose key assumptions and limitations, and adhere to industry standards for reporting.

4.6 Continuous Monitoring and Updating

- Focus on: Regularly monitoring and updating reserve estimates based on new data, technological advancements, and changes in market conditions.

- Actions: Conduct periodic reserve reviews, re-evaluate assumptions, and revise estimates as needed.

Chapter 5: Case Studies in 2P Reserves Estimation

This chapter presents case studies from the oil and gas industry, demonstrating the application of various techniques and models for estimating 2P reserves.

5.1 Case Study 1: Unconventional Shale Reservoir

- Objective: Estimate 2P reserves in a large shale gas play using probabilistic methods and Monte Carlo simulations.

- Methodology: A combination of volumetric and analogue methods, incorporating uncertainties in geological parameters, well performance, and gas prices.

- Outcome: A range of possible reserve estimates, providing a comprehensive assessment of the play's potential.

5.2 Case Study 2: Offshore Oil Field

- Objective: Estimate 2P reserves in a mature offshore oil field using production decline curve analysis and reservoir simulation.

- Methodology: Analyzing historical production data, calibrating reservoir models, and simulating future production under different scenarios.

- Outcome: A detailed estimate of remaining reserves, along with projections for future production.

5.3 Case Study 3: Tight Oil Play

- Objective: Estimate 2P reserves in a newly discovered tight oil play using deterministic methods and production forecasts.

- Methodology: Applying volumetric techniques, adjusting for recovery factors, and projecting production based on similar plays.

- Outcome: Initial estimates of reserves, providing a basis for further development planning.

5.4 Lessons Learned

Case studies illustrate the diversity of approaches to estimating 2P reserves, highlighting the importance of selecting appropriate techniques based on specific reservoir characteristics and data availability. They also emphasize the need for transparency, uncertainty analysis, and continuous monitoring in reserve estimation.

- Probable Reserves (2P) Unlocking the Potential: 2P R…

- Reserves, 1P Understanding Reserves: Unloc…

- Reserves, 3P Reserves: A Guide to Understa…

- Reserves, Behind Pipe Behind-the-Pipe: Unlocking Hi…

- Reserves, Developed Understanding "Reserves, Deve…

- Reserves, Entitlement Understanding Reserves and En…

- Reserves, Extension Reserves Extension: Expanding…

- Reserves, Non Producing Understanding "Reserves, Non-…

- Reserves, Possible Unlocking Potential: Understa…

- Reserves, Probable Understanding Probable Reserv…

- Reserves, Producing Unlocking the Potential: Unde…

- Reserves, Proved Understanding Proved Reserves…

- Reserves, Proved Developed Demystifying Oil & Gas Reserv…

- Reserves, Unproved Unlocking the Potential: Unde…

- Reserves, Recoverable Understanding Reserves and Re…

- Reserves, Undeveloped Untapped Potential: Understan…

- Application for Expenditure Justification Navigating the Appl… Project Planning & Scheduling

- Budgeted Cost of Work Scheduled ("BCWS") Understanding Budge… Cost Estimation & Control

- Battery limit Understanding Batte… General Technical Terms

- DV Tool (cementing) DV Tool: A Crucial … Drilling & Well Completion

- TOC TOC: Understanding … General Technical Terms

Comments